Saturday, November 23, 2024 05:46 PM

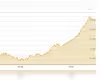

PSX Reaches New Heights, Surpassing 95,600 in Trading Surge

- PSX crosses 95,600 mark, reflecting strong investor sentiment.

- Finance Minister assures no new taxes during IMF discussions.

- Current account surplus reaches $349 million for October 2024.

Image Credits: thenews

Image Credits: thenewsThe PSX has surpassed 95,600, driven by positive investor sentiment and assurances from the Finance Minister regarding economic policies.

The Pakistan Stock Exchange (PSX) has recently made headlines by reaching a remarkable milestone, crossing the 95,600 mark during a day of trading. This surge in the stock market reflects a strong macroeconomic outlook and positive sentiments among investors, driven by reassurances from the finance minister regarding economic policies and the ongoing discussions with the International Monetary Fund (IMF).

On Tuesday, the KSE-100 Shares Index of the PSX climbed by 860.99 points, or 0.91%, reaching an intraday high of 95,856.66. At one point, the index even touched 96,036.48 points, although late profit-taking prevented it from maintaining that level. The trading session began at the previous close of 94,995.67, showcasing a positive momentum that was supported by strong performances in key sectors such as telecommunication, banking, and energy.

Among the most actively traded stocks were Hascol Petroleum, Waves Home Appliances, and TPL Properties, all of which experienced significant gains. This activity indicates robust participation from both retail and institutional investors. The positive investor sentiment was further bolstered by Finance Minister Mohammad Aurangzeb’s assurance that the recent IMF visit posed no threat to Pakistan’s $7 billion loan program. He confirmed that there were no discussions regarding additional taxes, particularly affecting the salaried class or the manufacturing sector.

Experts in the field, such as Muhammad Saad Ali from Intermarket Securities Ltd, noted that the conclusion of the IMF mission visit without any demands for new tax measures or a mini-budget is a significant positive factor that could help sustain the market's rally. He emphasized that liquidity in the market remains strong, with institutional investors acting as net buyers, especially as interest rates have decreased and are expected to fall further.

In addition to these developments, the government announced a landmark decision allowing Exploration and Production (E&P) firms to sell 35% of future gas discoveries to the private sector. This move aims to alleviate the circular debt issue in the energy sector and is expected to provide clarity and opportunities for private-sector involvement. The technology sector also contributed positively, with remittances from information and communication technology (ICT) exports rising by 34.9% year-on-year to $1.206 billion during the July-October 2024 period.

Furthermore, the current account surplus reported by the State Bank of Pakistan (SBP) for October 2024 was $349 million, marking the third consecutive monthly surplus. This improvement is attributed to a significant increase in remittances, which rose by 7% month-on-month and 24% year-on-year. The foreign exchange reserves have also reached a two-year high, enhancing confidence in the country’s economic recovery.

As the market continues to thrive, local mutual funds have shifted their investments from fixed-income securities to equities, contributing to a 20% surge in the benchmark index since September. Analysts have pointed out that the ongoing rally is supported by structural reforms, robust corporate earnings, and the absence of a mini-budget. The IMF’s acknowledgment of Pakistan’s progress in improving its tax-to-GDP ratio, along with the government’s focus on reforms for state-owned enterprises and independent power producers, has instilled confidence among investors.

The recent performance of the PSX reflects a combination of positive macroeconomic indicators, government reforms, and investor confidence. As the market continues to evolve, it is essential for investors to stay informed and consider the implications of these developments on their investment strategies. The ongoing improvements in the economic landscape suggest a promising outlook for the future, making it an exciting time for investors in Pakistan.