Saturday, November 23, 2024 06:13 PM

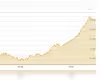

PSX Surpasses 97,000 Mark with 1,781.94 Points Gain

- PSX 100-Index reaches record closing high of 97,328.40 points.

- WorldCall Limited leads trading volume with 95.56 million shares.

- Global markets react to geopolitical tensions and mixed earnings reports.

Image Credits: dailytimes_pk

Image Credits: dailytimes_pkThe PSX 100-Index surged by 1,781.94 points, closing at 97,328.40, reflecting strong investor confidence amid global market uncertainties.

The Pakistan Stock Exchange (PSX) has recently made headlines with a remarkable surge in its 100-Index, which gained an impressive 1,781.94 points on Thursday. This increase represents a positive change of 1.87 percent, bringing the index to a record closing high of 97,328.40 points, compared to 95,546.46 points from the previous trading day. Such a significant rise in the stock market is a clear indication of growing investor confidence and optimism in the economic landscape of Pakistan.

On this bustling trading day, a total of 969,907,357 shares were exchanged, although this was a decrease from the 1,138,411,946 shares traded the day before. The total value of shares traded stood at Rs 35.167 billion, down from Rs 37.481 billion on the last trading day. Out of 457 companies that participated in the market, 249 saw their share prices increase, while 167 experienced declines. Interestingly, the share prices of 41 companies remained unchanged, showcasing a mix of performance across the board.

Among the top performers, WorldCall Limited led the trading volume with 95,563,962 shares changing hands at Rs 1.38 per share. Following closely were Pace (Pak) Limited and Kohinoor Spinning, with 51,499,190 shares at Rs 5.81 per share and 48,260,119 shares at Rs 8.40 per share, respectively. Notably, Pakistan Services Limited experienced the highest increase in share price, rising by Rs 80.17 to close at Rs 882.84. Haleon Pakistan Limited also performed well, with a rise of Rs 80.13, bringing its share price to Rs 882.45. Conversely, Rafhan Maize Products Company Limited faced a significant decline, with its share price dropping by Rs 137.27, while Services Industries Limited saw a decrease of Rs 74.86, closing at Rs 6,616.31.

In a broader context, global stock markets exhibited mixed trends as traders reacted to escalating tensions in the ongoing Russia-Ukraine conflict. Bitcoin, however, continued its upward trajectory, reaching a record high of over $98,000. Oil prices also saw an increase, driven by geopolitical tensions that overshadowed concerns regarding rising US crude supplies. As noted by analysts, these geopolitical fears have led investors to seek safety in gold, which has also seen a rise in recent sessions.

As the world watches the developments in Ukraine, with Kyiv accusing Russia of launching an intercontinental ballistic missile attack, the impact on global markets remains uncertain. Meanwhile, Asian and European stock markets displayed varied performances, influenced by the recent earnings report from US chip giant Nvidia, which, despite smashing forecasts, fell short of investor expectations, leading to a decline in its stock price.

In the corporate arena, shares of the Indian conglomerate Adani Group plummeted following allegations against its owner, Gautam Adani, for bribery. This news has sent shockwaves through the market, with flagship operation Adani Enterprises diving nearly 20 percent. On a brighter note, the cryptocurrency market continues to thrive, with Bitcoin nearing the coveted $100,000 mark, fueled by speculation surrounding a potential return of Donald Trump to the White House, which many believe could lead to a more crypto-friendly regulatory environment.

The recent performance of the PSX reflects a positive sentiment among investors, despite the backdrop of global uncertainties. As the market continues to evolve, it is essential for investors to stay informed and consider both local and international factors that could influence their investment decisions. The interplay between geopolitical events and market performance serves as a reminder of the complexities of investing in today’s interconnected world.