Saturday, November 16, 2024 05:28 PM

Revamping Pakistan's Public Sector Enterprises for Economic Growth

- Public sector enterprises need effective governance, not privatisation.

- Restructuring can transform loss-making entities into profit generators.

- Global talent is essential for managing Pakistan's public sector companies.

Image Credits: pakistantoday

Image Credits: pakistantodayPakistan's public sector enterprises require restructuring and effective governance to drive economic growth, rather than hasty privatisation.

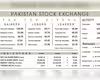

For over three decades, the issue of Loss-making Public Sector Enterprises (PSEs) and their privatisation has been a significant concern in Pakistan. Successive governments, whether military or civilian, have pointed to the financial losses incurred by these enterprises as a major contributor to the country’s economic and fiscal challenges. The urgency to divest these institutions has led to a series of hurried privatisation efforts, with mixed results. While there have been a few success stories, particularly in the banking sector, many of these transactions have not proven beneficial for the government or the enterprises involved.

Upon closer examination, it becomes evident that the real problem lies not in the existence of public sector enterprises but rather in the lack of a robust corporate governance structure, which is often compromised by bureaucratic control. The staggering losses reported at PSEs, which reached approximately PKR 900 billion in the fiscal year 2022-23, up from PKR 700 billion the previous year, paint a grim picture. However, this narrative often overlooks the fact that several PSEs contribute significantly to the national revenue, generating substantial profits through federal, provincial, and military-run businesses.

For instance, the combined profits from key players like Pakistan State Oil, Pakistan Petroleum Ltd, Mari Gas, and Oil & Gas Development Corporation Ltd amount to around PKR 400 billion, with expectations for growth in the current year. When considering the entire portfolio of PSEs, it becomes clear that while some entities are indeed loss-making, others are thriving and contributing positively to the economy.

A significant portion of the losses can be attributed to the power sector, which remains dysfunctional and unlikely to attract buyers unless the government assumes all liabilities and offers ongoing subsidies. This scenario raises concerns about the government relinquishing control over valuable assets while still being burdened with future liabilities.

Privatisation has often been touted as the ultimate solution to the economic woes associated with PSEs. However, this perspective is rooted in outdated economic theories from the 1980s and 1990s, which fail to account for the evolving global landscape. Countries like China, Singapore, and those in the Gulf Cooperation Council (GCC) have demonstrated that well-managed PSEs can drive economic growth and stability.

The crux of the issue lies not in the ownership of these enterprises but in the government's inability to manage them effectively due to bureaucratic inefficiencies. Instead of hastily offloading these entities at undervalued prices, a comprehensive restructuring plan is essential. This plan should focus on two key aspects: structural and operational reforms.

On the structural side, the government should consider consolidating its holdings under a single portfolio holding company. This entity would oversee all PSEs, providing strategic direction and ensuring accountability. Drawing inspiration from Singapore's Temasek Holdings, the board of this holding company should consist of professionals tasked with setting profitability targets aligned with the government's economic and social objectives.

Moreover, it is crucial to acknowledge that, at present, Pakistan lacks the necessary human resources and top-level management expertise to run these enterprises effectively. Therefore, hiring global talent to lead the holding company and PSEs is imperative. This approach has been successfully implemented by GCC nations, which actively seek the best global talent to manage their investment funds and PSEs.

Additionally, it is vital to keep government officials out of the corporate governance and management of these entities. This separation is essential to avoid conflicts of interest and ensure that businesses are run by individuals with the requisite expertise rather than bureaucratic experience.

The path forward for Pakistan’s public sector companies lies not in privatisation but in a thoughtful restructuring that prioritises effective governance and management. By embracing global best practices and focusing on the strengths of its PSEs, Pakistan can transform these enterprises into engines of economic growth, ultimately benefiting the nation as a whole. The time has come for a paradigm shift in how we view and manage our public sector enterprises, ensuring they contribute positively to the economy rather than being seen as a burden.