Saturday, November 16, 2024 07:31 PM

Pakistan's Agricultural Crisis: A Call for Urgent Reforms

- Food security threatened by climate change and economic instability.

- Investment in agricultural infrastructure is critically needed.

- REITs could attract private investment for modernization.

Image Credits: dawn

Image Credits: dawnPakistan faces a severe agricultural crisis due to climate change and economic challenges, necessitating urgent reforms and investment.

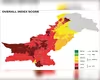

Pakistan, a vast nation with over 225 million people, is grappling with significant challenges in feeding its growing population. With a population growth rate of 2.55% per year, the country faces the urgent task of ensuring food security. Compounding this issue is the reality of climate change, which places Pakistan among the top ten countries at risk globally. The economy is in a precarious state, burdened by one of the highest ratios of GDP to public debt in the world. This situation makes it increasingly difficult to invest in vital sectors, particularly agriculture, which is in dire need of modernization.

One glaring example of the agricultural infrastructure's fragility was witnessed in June 2023, when a gate at the Sukkur barrage collapsed during the inundation season. Fortunately, the Sindh Irrigation Department managed to restore supplies to the province's seven off-taking canals within three weeks, averting a potential disaster for rice and cotton crops during their peak demand period. However, the current budget for 2024-25 reveals that the country has little to no spare cash for investing in agricultural infrastructure, which is crucial for ensuring food security in the years to come.

Global warming is no longer a distant threat; it is a present reality. The excessive heat has devastated cotton crops and severely affected paddy yields, leading to anticipated losses in the hundreds of billions of rupees for farmers in Sindh and Punjab. The wheat crisis of 2024 still looms large, with many farmers in Punjab struggling to recover from their losses. The challenge is exacerbated by the fact that a significant portion of Pakistan's revenue is allocated to debt servicing, defense, and current government expenditures, leaving little room for infrastructural development.

While there is a call for increased private sector involvement in agricultural development, it is essential to clarify what this entails. Real Estate Investment Trusts (REITs) could serve as a viable model for attracting investment in agriculture, particularly in irrigation and drainage systems. However, this requires a robust policy framework from the government, including incentives such as tax breaks and a focus on foreign investment.

The Special Investment Facilitation Council (SIFC) must reconsider its current strategy of expansive land development, as many questions arise regarding the feasibility of cultivating "millions of acres of barren land." The recent discussions surrounding amendments to the Indus River System Authority have also sparked tensions within the ruling setup, particularly in Sindh. It is crucial to recognize that freshwater availability, not merely land, is the limiting factor for agricultural development in Pakistan.

To address these challenges, the SIFC must collaborate with reputable Pakistani businesses to create synergies with existing farmers. The government should also consider long-term tax relief for REITs, despite the frequent requests for concession renewals. Projects focused on irrigation and drainage could be based on canal command systems, promoting market-based investments in water conservation. Farmers, as consumers of irrigation services, should be charged for improved services, aligning with the Provincial Irrigation and Drainage Acts of 1997, which stipulate that the government should recover full costs from farmers.

Moreover, it is essential to eliminate price suppression of farm produce, as farmers cannot afford world-class irrigation services if their produce prices remain low. REITs should also engage in processing and value addition, particularly in regions where local production exceeds demand during peak seasons. This would allow farmers to sell their produce directly to processing companies or utilize these companies' services to market value-added products.

Another critical change needed is the removal of the minimum export price (MEP) for agricultural exports. This arbitrary pricing mechanism hinders the viability of Pakistani produce, such as potatoes, onions, and tomatoes, in lucrative markets like Dubai. Without addressing price suppression and export controls, Pakistan's agriculture sector will remain trapped in a cycle of low value and persistent food insecurity.

For REITs to succeed in agriculture, a collaborative effort is required from both the business sector and the government. By fostering an environment conducive to investment and innovation, Pakistan can pave the way for a more sustainable agricultural future. The road ahead may be challenging, but with the right policies and partnerships, there is hope for revitalizing the agricultural sector and ensuring food security for the nation.