Monday, December 23, 2024 04:36 AM

Asian Markets React to Geopolitical Tensions and Nvidia Earnings

- Asian markets fluctuate amid geopolitical tensions.

- Nvidia's earnings report is highly anticipated.

- Ukraine conflict escalates with missile launch.

Image Credits: urdupoint

Image Credits: urdupointAsian markets fluctuate as traders assess geopolitical tensions and await Nvidia's earnings report amid rising concerns over the Ukraine conflict.

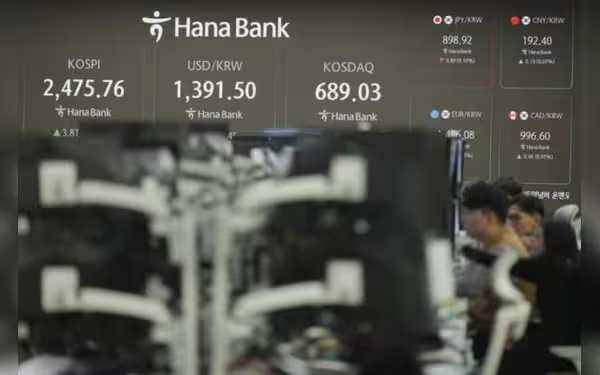

Asian markets experienced fluctuations on Wednesday as traders navigated a complex landscape of geopolitical tensions and economic forecasts. The backdrop of these market movements includes the ongoing Russia-Ukraine conflict, the implications of Donald Trump's potential second presidency, and the anticipated trajectory of US interest rates. Investors are particularly cautious this week, reflecting on the uncertainty surrounding Trump's re-election and his cabinet selections, which may include several individuals known for their tough stance on China.

As traders assessed these developments, they were also eagerly awaiting earnings reports from Nvidia, a leading player in the technology sector. Nvidia's performance is closely watched as it is seen as a bellwether for the tech industry and the demand for artificial intelligence (AI) products. The company has seen its stock soar by an impressive 200 percent this year, driven by a surge in AI-related demand, and many are hoping it will continue to meet high expectations.

In the midst of these market dynamics, the situation in Ukraine has resurfaced as a significant concern. Recent reports indicate that Kyiv has launched a US-made long-range missile into Russian territory, prompting a stern response from Moscow. Russian officials have expressed that this escalation could mark a new phase in the conflict, raising fears of a broader confrontation. The geopolitical landscape is further complicated by President Vladimir Putin's recent decree to lower the threshold for using nuclear weapons, a move that has drawn widespread condemnation from Western leaders.

Despite these tensions, the US stock markets, including the S&P 500 and Nasdaq, managed to rise for a second consecutive day, indicating a degree of resilience among investors. In Asia, while some markets began the day in the red, others, such as Hong Kong and Shanghai, managed to recover as trading progressed. This mixed performance highlights the uncertainty that continues to grip the region.

As the day unfolded, the focus remained on Nvidia's upcoming earnings report. Analysts are keen to see if the company can sustain its remarkable growth and provide insights into its new chip offerings. The anticipation surrounding Nvidia's performance underscores the broader question of whether the AI boom is robust enough to maintain investor enthusiasm or if it is beginning to show signs of weakness.

The fluctuations in Asian markets reflect a complex interplay of geopolitical tensions and economic forecasts. As traders weigh the implications of these developments, the performance of key companies like Nvidia will be crucial in shaping market sentiment. Investors are advised to stay informed and consider the potential impacts of these global events on their portfolios. The coming days will be pivotal as the world watches how these narratives unfold and influence market dynamics.