Saturday, November 16, 2024 03:22 PM

Federal Reserve Implements Aggressive Rate Cut to Balance Inflation and Employment

- Fed cuts interest rates by half a percentage point.

- Inflation rates have significantly declined recently.

- Goal is to stimulate economic growth and job creation.

Image Credits: tribune.com.pk

Image Credits: tribune.com.pkThe Federal Reserve's recent interest rate cut aims to balance inflation control and job creation amid changing economic conditions.

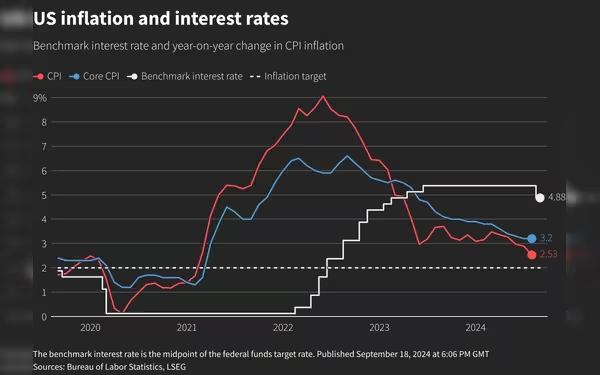

The US Federal Reserve has recently made headlines by implementing a significant interest rate cut, a move that has been widely anticipated by economists and market analysts alike. This decision comes in the wake of a notable decline in inflation rates, which have dropped sharply compared to the previous year. The Federal Reserve, often referred to as the Fed, plays a crucial role in managing the economy by adjusting interest rates, which can influence everything from consumer spending to employment rates.

On Wednesday, the Fed announced a half-percentage-point reduction in interest rates, a larger cut than what is typically seen. Federal Reserve Chair Jerome Powell described this action as a "recalibration" of monetary policy. This term suggests that the Fed is not just making a random decision but is carefully adjusting its approach based on current economic conditions. The goal of this rate cut is to strike a balance between controlling inflation and promoting employment.

Inflation, which refers to the rate at which prices for goods and services rise, has been a significant concern for many countries, including the United States. When inflation is high, it can erode purchasing power, making it more expensive for consumers to buy everyday items. However, the recent data indicates that inflation has been falling, allowing the Fed to take this bold step. By lowering interest rates, the Fed hopes to encourage borrowing and spending, which can help stimulate economic growth and create jobs.

Moreover, this decision reflects a broader strategy to support the economy as it navigates through various challenges. The Fed's actions are closely watched by investors, businesses, and policymakers, as they can have far-reaching implications. A lower interest rate typically means cheaper loans for consumers and businesses, which can lead to increased investment and spending.

The Federal Reserve's aggressive rate cut is a strategic move aimed at balancing inflation control with the need for job creation. As the economy continues to evolve, it is essential for the Fed to remain vigilant and responsive to changing conditions. This recalibration of interest rates not only reflects current economic realities but also sets the stage for future growth. For individuals and businesses alike, understanding these changes can provide valuable insights into how to navigate the financial landscape in the coming months.