Sunday, December 22, 2024 09:35 AM

FBR Confirms No Reduction in Karachi Property Values

- FBR announces no cut in property values for Karachi.

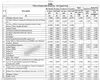

- New valuation table issued under S.R.O.1724 (I)/2024.

- Tax experts seek clarity on previous property rebates.

Image Credits: brecorder

Image Credits: brecorderFBR confirms no reduction in Karachi property values under new valuation table, raising concerns among property owners and tax experts.

In recent developments concerning the real estate market in Karachi, the Federal Board of Revenue (FBR) has made a significant announcement regarding the valuation of immovable properties. The FBR's field office has confirmed that there will be no reduction in the values listed in the new valuation table for Karachi, as outlined in S.R.O.1724 (I)/2024. This decision has raised eyebrows among tax experts and property owners alike, as many were hoping for a decrease in property values to ease the financial burden on homeowners.

The FBR's statement is clear: "Hence the calculation method for reduction rates of immovable properties is withdrawn and no reduction in values is offered in the current valuation table." This means that the previous methods used to calculate property values, which may have allowed for some reductions, are no longer applicable. The tax office in Karachi has emphasized that the new valuation table will stand as is, without any adjustments.

Tax experts are now calling for urgent clarification from the FBR regarding the status of previous rebates on immovable properties in Karachi. They are particularly interested in understanding whether these rebates will still be applicable under the new S.R.O.1724 (I)/2024. The communication sent to the FBR highlights that the current notification, issued on October 29, 2024, does not provide any rebates compared to earlier notifications.

In response to these concerns, the Regional Tax Office-I Karachi has issued a clarification. According to their statement, the current notification explicitly states, "in suppression of S.R.O.345(I)/2022," indicating that the previous notification is no longer valid. This clarification has left many property owners and tax experts in a state of uncertainty, as they seek to understand the implications of this change.

As the real estate market in Karachi continues to evolve, it is crucial for property owners to stay informed about these developments. The lack of reductions in property values could have significant financial implications for many individuals and families. It is advisable for homeowners to consult with tax professionals to navigate these changes effectively and to ensure they are making informed decisions regarding their properties.

The FBR's recent announcement regarding immovable properties in Karachi has sparked a wave of questions and concerns. While the intention behind the new valuation table may be to standardize property values, the absence of reductions and rebates could pose challenges for many. As the situation unfolds, it is essential for all stakeholders to remain vigilant and proactive in seeking clarity and understanding in this complex landscape.