Friday, October 4, 2024 06:29 AM

Pakistan Stock Market Gains Amid Inflation Decline

- Stock market gains despite geopolitical tensions.

- Inflation drops to 44-month low of 6.9%.

- Foreign investors continue to sell shares.

Image Credits: dawn

Image Credits: dawnPakistan's stock market extends gains as inflation drops to a 44-month low, despite ongoing geopolitical tensions and foreign selling.

KARACHI: The stock market in Pakistan has shown resilience, extending its gains on Wednesday despite geopolitical tensions arising from the Iranian missile attack on Israel. Investors are increasingly optimistic about the possibility of another cut in the policy rate, which is a key interest rate set by the State Bank of Pakistan. This optimism comes in the wake of inflation rates that have recently dropped to a 44-month low of 6.9% in September, as reported by Standard and Poor’s Global Marketing Intelligence.

According to forecasts, the State Bank may implement multiple cuts in its policy rate during the current fiscal year, with an anticipated reduction of 200 basis points (bps) before the end of December. However, it is important to note that average inflation is expected to remain in double digits due to the impact of IMF-driven taxation measures and high energy prices, which are pushing up production costs.

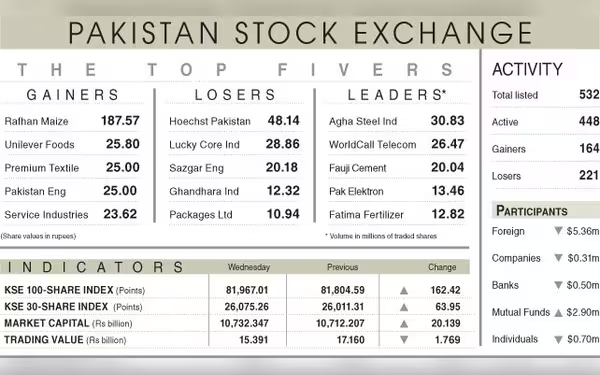

Ahsan Mehanti from Arif Habib Corporation highlighted that the S&P’s projection of a fourth consecutive rate cut, along with a rise in petroleum sales in September and a surge in global oil prices, contributed to the positive closing of the market. The benchmark KSE-100 index closed at 81,967, marking an increase of 162.41 points or 0.20%. The trading session was marked by significant volatility, with the index peaking at 82,360 and dipping to 81,529, primarily influenced by ongoing geopolitical tensions.

The market was driven by key players such as United Bank, Fauji Fertiliser, MCB Bank, Engro Corporation, and Pakgen Power Ltd, which collectively contributed 270 points to the index. Trading activity was robust, with 360 million shares changing hands, amounting to a total value of Rs15.3 billion. Notable stocks that contributed to the trading volume included Agha Steel Industries (30.83 million shares), WorldCall Telecom (26.47 million shares), and Fauji Cement (20.04 million shares).

In terms of price movements, Rafhan Maize saw the most significant increase, rising by Rs187.57, followed by Unilever Foods, Premium Textile, Pakistan Engineerings Ltd, and Service Industries. Conversely, companies such as Hoechst Pakistan, Lucky Core Industries, and Sazgar Engineering Works Ltd experienced notable declines in their share prices.

Despite the positive market performance, foreign investors continued to be net sellers, offloading shares worth $5.36 million. On the other hand, mutual funds maintained their buying momentum, acquiring shares worth $2.90 million.

While the stock market in Pakistan is currently buoyed by expectations of a policy rate cut and declining inflation, the ongoing geopolitical tensions and foreign selling present challenges. Investors should remain vigilant and informed, as the market dynamics can shift rapidly. Understanding these factors is crucial for making informed investment decisions in an ever-changing economic landscape.