Thursday, November 7, 2024 05:54 AM

Meezan Bank and ITFC Join Forces to Boost Islamic Trade Finance in Pakistan

- Meezan Bank partners with ITFC for trade finance enhancement.

- First bank in Pakistan to offer ITFC LC Confirmation facility.

- Collaboration aims to support SMEs in international trade.

Image Credits: nation_pk

Image Credits: nation_pkMeezan Bank partners with ITFC to enhance Islamic trade finance in Pakistan, supporting SMEs and streamlining international trade transactions.

In recent years, the landscape of trade finance has evolved significantly, particularly in Islamic banking. As global trade continues to expand, the need for reliable and secure financial solutions has become paramount. In this context, Meezan Bank, Pakistan's leading Islamic bank, has taken a significant step forward by partnering with the International Islamic Trade Finance Corporation (ITFC). This collaboration aims to enhance Islamic trade finance in Pakistan, providing a robust framework for facilitating international trade.

The partnership centers around the ITFC Letter of Credit (LC) Confirmation product, which is designed to streamline trade transactions. This product offers exporters and issuing banks the assurance they need to secure payments, effectively eliminating credit risks. By working closely with local banks in Organisation of Islamic Cooperation (OIC) member countries, this initiative will support private sector clients, including small and medium-sized enterprises (SMEs), in executing various import transactions.

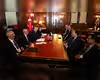

The agreement was formalized by Nazeem Noordali, Chief Operating Officer of ITFC, and Syed Amir Ali, Deputy Chief Executive Officer of Meezan Bank, with executives from both organizations present to witness this important milestone. Notably, Meezan Bank is the first bank in Pakistan to collaborate with ITFC for the LC Confirmation facility, marking a significant achievement in the realm of Islamic finance.

This new Islamic trade facility will empower Meezan Bank to extend its geographical reach by leveraging the extensive ITFC network, which spans both member and non-member countries. Furthermore, it will enable the bank to manage longer-term LC Confirmation transactions, ranging from six to twelve months. This flexibility is crucial for businesses looking to navigate the complexities of international trade.

Syed Amir Ali emphasized the importance of this partnership, stating, "Today marks a significant milestone in our business relationship with ITFC as we solidify our partnership. This arrangement reinforces our bank’s commitment to reliability, stability, and financial excellence. The Letter of Credit Confirmation Agreement strengthens our position in the market, enabling us to capitalize on new opportunities and facilitate international Islamic trade."

In a similar vein, Nazeem Noordali expressed pride in the collaboration, noting, "We are proud to strengthen our partnership with Meezan Bank through this Letter of Credit Confirmation Agreement, which reflects our commitment and support to private sector clients in our member countries."

This partnership not only signifies a leap forward for Meezan Bank but also highlights the growing importance of Islamic finance in the global trade arena. As businesses increasingly seek secure and reliable financial solutions, initiatives like this one pave the way for enhanced trade opportunities. The collaboration between Meezan Bank and ITFC is a testament to the potential of Islamic finance to foster economic growth and stability in Pakistan and beyond.