Thursday, November 21, 2024 01:01 PM

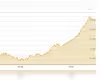

Pakistan Stock Exchange Hits Record High Surpassing 96,000 Points

- PSX surpasses 96,000 points during intraday trading.

- Current account surplus of $349 million boosts investor confidence.

- Central bank cuts key policy rate to stimulate economic activity.

Image Credits: arabnewspk

Image Credits: arabnewspkPakistan Stock Exchange reaches a historic high of 96,000 points, driven by a current account surplus and increased investor confidence.

On Tuesday, the Pakistan Stock Exchange (PSX) achieved a remarkable milestone by surpassing the 96,000 points mark during intraday trading. This surge is a significant indicator of the country's economic recovery and investor confidence, driven primarily by a current account surplus reported for October 2024. Analysts have pointed out that this positive trend is largely due to increased remittances, exports, and foreign direct investment (FDI), which have collectively bolstered the nation’s financial standing.

The benchmark KSE-100 index experienced a notable rise, climbing by 935.66 points or 0.98 percent, reaching a new high of 95,931.33 points, up from the previous close of 94,995.67 points. At 2:44 PM PST, the index even touched an impressive 96,036.48 points, marking a historic moment for the PSX.

Ahsan Mehanti, an analyst at the Arif Habib Corporation, highlighted that potential investors are encouraged by the rising foreign reserves and the government's commitment to reforming loss-making state-owned enterprises, independent power producers, and energy pricing. He stated, "Stocks bullish on reports of current account surplus of $349 million in Oct. 2024 on higher remittances, exports and FDI rising by 32pc to $904m for Jul-Oct. 2024." This indicates a growing optimism among investors regarding the economic landscape of Pakistan.

Pakistan's external current account recorded a surplus of $349 million in October 2024, marking the third consecutive month of surplus and the highest surplus in this period. A surplus in the current account signifies that the country is exporting more than it is importing, which in turn strengthens its foreign exchange reserves. This is a crucial development, especially after the country faced a prolonged economic crisis that severely impacted its foreign exchange reserves and led to a depreciation of its currency amid soaring inflation.

The bullish trend in the stock market can also be attributed to the recent decision by Pakistan's central bank to cut its key policy rate by 250 basis points, bringing it down to 15 percent. This move is expected to stimulate economic activity and encourage investment. Furthermore, the economic indicators have shown steady improvement since Pakistan secured a 37-month, $7 billion bailout from the International Monetary Fund (IMF) in September. This bailout was critical in averting a potential sovereign default, which had loomed large over the nation.

As the stock market continues to thrive, it is essential for investors to remain vigilant and informed. The easing of political tensions and the potential for further economic reforms could serve as additional catalysts for growth. The current economic climate presents a unique opportunity for both local and foreign investors to engage with the market. However, it is crucial to approach investments with caution and a well-informed strategy, as the landscape can change rapidly. Overall, the recent developments in the Pakistan Stock Exchange reflect a hopeful outlook for the country's economy, paving the way for a more stable financial future.