Saturday, November 16, 2024 05:55 PM

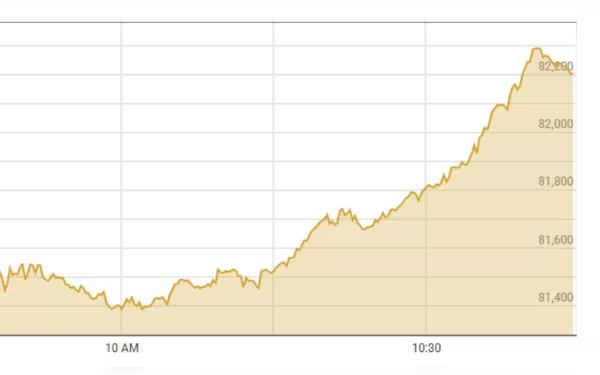

PSX Hits Record High, Surpasses 82,000 Points

- PSX breaches 82,000 points in intraday trading.

- Commercial banks contribute 675 points to KSE-100 index.

- IMF approves $7 billion Extended Fund Facility.

Image Credits: dawn.com

Image Credits: dawn.comThe PSX surges to an all-time high, surpassing 82,000 points, driven by positive investor sentiment and IMF support.

The Pakistan Stock Exchange (PSX) has recently made headlines as it surged to an all-time high, breaching the significant milestone of 82,000 points during intraday trading. This remarkable achievement reflects a positive shift in investor sentiment and market dynamics, particularly in the wake of easing concerns surrounding Non-Performing Loans (NPLs) in the banking sector.

Commercial banks played a pivotal role in this upward movement, contributing a substantial 675 points to the KSE-100 index. The easing of worries regarding NPL accumulation has been a breath of fresh air for investors, as it indicates a healthier financial environment. Strong financial performance and improved solvency ratios among banks have further bolstered confidence in the market.

One of the key drivers behind this exuberant market performance is the recent approval from the International Monetary Fund (IMF) for a $7 billion Extended Fund Facility (EFF). This approval is expected to provide much-needed financial stability and support to Pakistan's economy. Additionally, there are growing expectations of monetary easing in November, which could further stimulate economic activity and investment.

As the market continues to rally, it is essential for investors to remain informed and cautious. While the current trends are promising, the financial landscape can change rapidly. Investors should consider diversifying their portfolios and staying updated on economic indicators and policy changes that may impact the market.

The PSX's recent surge to an all-time high is a testament to the resilience of the Pakistani economy and the banking sector's recovery. As the market navigates through these positive developments, it is crucial for investors to approach opportunities with a balanced perspective, ensuring they are well-prepared for any potential fluctuations in the future.