Friday, October 4, 2024 06:18 AM

Pakistan Stock Market Faces Continued Decline Amid Economic Uncertainty

- KSE 100 index declines for third consecutive session.

- Political tensions and IMF conditions weigh on investors.

- Foreign investors offload shares, contributing to market downturn.

Image Credits: dawn

Image Credits: dawnThe KSE 100 index continues to decline amid economic uncertainty and rising political tensions, impacting investor confidence.

KARACHI: The stock market in Pakistan has been experiencing a challenging phase, with the benchmark KSE 100 index facing losses for the third consecutive session. This downturn is primarily attributed to an uncertain economic outlook, which has left equity investors feeling anxious. Political tensions are rising, and the strict conditions imposed by the International Monetary Fund (IMF) regarding the $7 billion bailout have further complicated the situation. Additionally, the ongoing conflict in the Middle East has led to foreign investors offloading their holdings, adding to the market's woes.

Ahsan Mehanti from Arif Habib Corporation highlighted that the equity market remains depressed due to increasing political uncertainty and significant dollar outflows observed in the first two months of the current fiscal year. He pointed out that the government's actions concerning independent power producers' tariffs, worries about tax collection shortfalls, and delays in the privatization of state-owned enterprises have all contributed to the bearish trend at the Pakistan Stock Exchange (PSX).

According to a review by Topline Securities, the main factor driving the market down was Hub Power, which saw a decline of 3.6%. This drop was fueled by concerns over possible revisions to its power plant contracts and its ability to pay out dividends. Other stocks that contributed to the downward momentum included Meezan Bank Ltd, TRG Pakistan, Bank Al-Habib, and Engro Corporation, which collectively reduced the index by 194 points.

In a contrasting move, Mari Petroleum's share price initially dropped after the distribution of bonus shares to investors. However, it managed to recover, closing the day with a gain of 4.1%, which added 130 points to the index. Throughout the trading session, the KSE-100 index fluctuated between a high of 81,321.64 points and a low of 80,352.22 points, ultimately settling at 81,114.20 points after a loss of 177.93 points, or 0.22%, from the previous day.

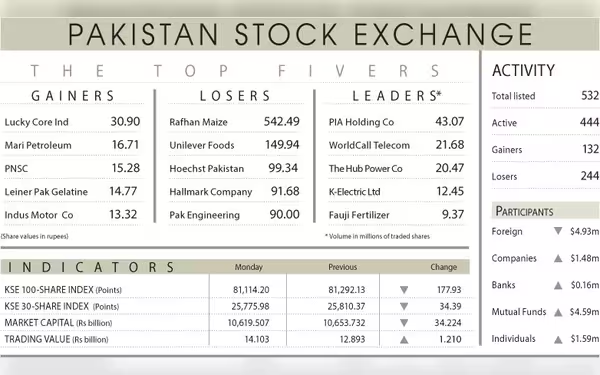

The trading volume also saw a decline of 12.17%, totaling 297.99 million shares. However, the traded value increased by 9.38%, reaching Rs14.10 billion. Notable contributors to the trading volume included PIA Holding Co (43.07 million shares), WorldCall Telecom (21.68 million shares), The Hub Power Company (20.47 million shares), K-Electric Ltd (12.45 million shares), and Fauji Fertiliser Bin Qasim (9.37 million shares).

In terms of price movements, Lucky Core Industries saw the most significant increase, rising by Rs30.90, followed by Mari Petroleum Ltd (Rs16.71), Pakistan National Shipping Company (Rs15.28), Leiner Pak Gelatine (Rs14.77), and Indus Motor Company (Rs13.32). Conversely, companies that faced major losses included Rafhan Maize Products Company Ltd (Rs542.49), Unilever Pakistan Foods Ltd (Rs149.94), Hoechst Pakistan (Rs99.34), Hallmark Company (Rs91.68), and Pakistan Engineering Company (Rs90.00).

Foreign investors continued to be net sellers, offloading shares worth $4.93 million. Despite these challenges, it is worth noting that the KSE-100 index had increased by 2,626 points or 3.3% month-on-month in September, indicating that the market can rebound from difficult periods.

The current state of the stock market reflects a complex interplay of economic and political factors. Investors are advised to stay informed and exercise caution as the situation evolves. Understanding these dynamics is crucial for making informed investment decisions in such turbulent times.