Friday, October 4, 2024 08:27 AM

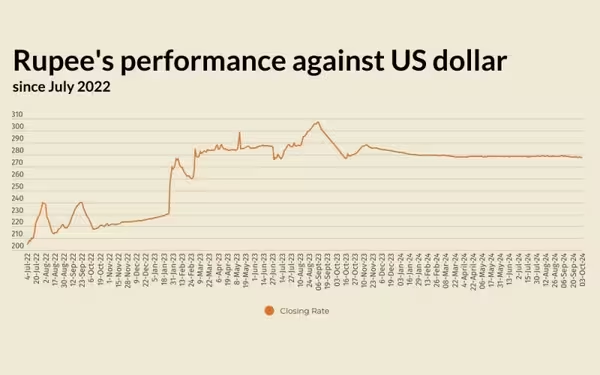

Pakistani Rupee Declines Marginally Against US Dollar

- Rupee depreciates 0.03% against US dollar.

- US dollar reaches one-month high amid global tensions.

- Oil prices rise due to Middle East conflict concerns.

Image Credits: brecorder

Image Credits: brecorderThe Pakistani rupee sees a slight decline against the US dollar, closing at 277.74 amid global economic tensions and rising oil prices.

The Pakistani rupee has experienced a slight decline against the US dollar, marking a depreciation of 0.03% in the inter-bank market on Thursday. The currency closed at 277.74, reflecting a loss of Re0.10 against the greenback. This follows Wednesday's closing rate of 277.64, as reported by the State Bank of Pakistan (SBP).

In the global arena, the US dollar has surged to a one-month high against the Japanese yen, driven by strong performance in the US jobs market. This has led to speculation that the Federal Reserve may not need to hastily reduce interest rates. Additionally, the US dollar saw increased demand following Iran's launch of approximately 180 ballistic missiles into Israel, which has raised concerns about potential widespread conflict.

The dollar index, which gauges the US currency against a basket of other major currencies including the euro and yen, rose to 101.70 as of 0023 GMT, reaching a three-week high. This increase extends a 0.45% rise from the previous session. Currently, traders are estimating a 34.6% chance of another 50 basis-point rate cut by the Federal Reserve on November 7. This figure has decreased from 36.8% a day earlier and 57.4% a week ago, according to the CME Group’s FedWatch Tool. However, some analysts, like Ray Attrill from National Australia Bank, believe these odds still appear too high.

Oil prices, which are crucial for currency valuation, also saw an uptick on Thursday. The potential for escalating conflict in the Middle East, which could disrupt crude oil supplies, has overshadowed a more favorable global supply outlook. Brent crude futures increased by $1.02, or 1.38%, reaching $74.92 a barrel by 0840 GMT, while US West Texas Intermediate crude futures rose by $1.10, or 1.57%, to $71.20.

In the open market, the Pakistani rupee remained stable for buying and gained 2 paise for selling against the US dollar, closing at 278.33 and 279.86, respectively. When compared to the euro, the rupee appreciated by 56 paise for buying and 63 paise for selling, closing at 304.92 and 307.72, respectively. However, against the UAE Dirham, the rupee lost 11 paise for buying and 9 paise for selling, closing at 75.47 and 76.17, respectively. Similarly, against the Saudi Riyal, the rupee saw a decline of 11 paise for buying and 8 paise for selling, closing at 73.72 and 74.36, respectively.

The fluctuations in the value of the Pakistani rupee against the US dollar and other currencies reflect broader economic trends and geopolitical tensions. As the global market continues to react to various factors, including interest rate expectations and international conflicts, it is essential for investors and consumers alike to stay informed. Understanding these dynamics can help individuals make better financial decisions in an ever-changing economic landscape.