Saturday, November 16, 2024 07:33 PM

Pakistani Rupee Marginally Appreciates Against US Dollar

- Rupee gains 0.03% to close at 278.68.

- US dollar dips amid rate cut speculation.

- Ongoing IMF discussions crucial for economic stability.

Image Credits: brecorder

Image Credits: brecorderThe Pakistani rupee appreciates slightly against the US dollar, closing at 278.68 amid ongoing IMF discussions and global economic uncertainties.

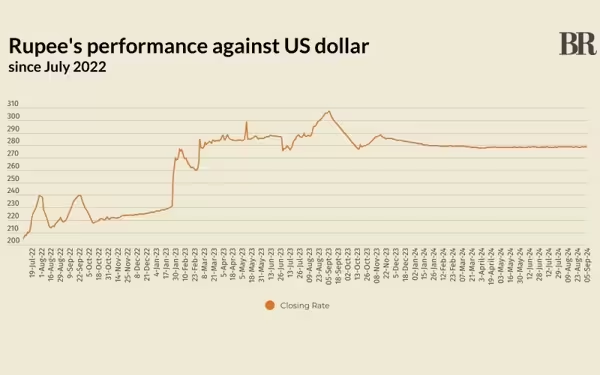

The Pakistani rupee has shown a slight improvement against the US dollar, marking a 0.03% appreciation in the inter-bank market on Thursday. This change means that the rupee closed at 278.68, gaining Re0.09 compared to the previous day when it settled at 278.77. This fluctuation in the currency's value is significant as it reflects ongoing economic conditions and market sentiments.

In recent months, the rupee has been trading within a narrow range of 277-279. Traders are closely monitoring developments related to the International Monetary Fund’s (IMF) Executive Board, particularly concerning a new $7-billion Extended Fund Facility (EFF). The outcome of these discussions is crucial for the stability of the Pakistani economy and the rupee's performance.

On a global scale, the US dollar experienced a dip on Thursday. This decline can be attributed to traders increasing their bets on a potential significant rate cut by the Federal Reserve later this month. The Japanese yen has emerged as a strong performer, driven by safe-haven demand amid renewed concerns regarding the growth outlook of the US economy. Recent data has suggested that the US economy may not be as robust as previously thought, leading to a cautious approach among investors.

As a result, many investors are seeking safety in less risky assets, with the yen benefiting the most from this trend. The US dollar was under pressure during early trading in Asia, while the euro remained steady at $1.1083 and the British pound was little changed at $1.3147. Against a basket of currencies, the dollar fell slightly to 101.25.

Market analysts are now pricing in a 44% chance of a significant 50-basis-point rate cut by the Federal Reserve, an increase from 38% just a week ago. This shift in expectations highlights the growing uncertainty surrounding the US economy and its impact on global markets.

In terms of oil prices, which are a key indicator of currency parity, there was a slight increase on Thursday. Brent crude for November rose by 42 cents, or 0.6%, reaching $73.12 a barrel, while US West Texas Intermediate crude for October increased by 37 cents, or 0.5%, to $69.57. These gains were supported by discussions among OPEC and its allies regarding potential output increases, although concerns about demand continue to cap further price rises.

In the open market, the Pakistani rupee faced some challenges. It lost 13 paise for buying, closing at 279.33, while the selling rate remained unchanged at 280.25 against the US dollar. The rupee also experienced losses against the euro, UAE dirham, and Saudi riyal, indicating a mixed performance in the currency market.

While the Pakistani rupee has shown a slight gain against the US dollar, the overall economic landscape remains uncertain. The ongoing discussions with the IMF and global economic conditions will play a pivotal role in determining the future trajectory of the rupee. For investors and traders, staying informed about these developments is essential, as they can significantly impact currency values and investment strategies.