Sunday, June 30, 2024 06:42 PM

Pakistan's Balance of Payments Deficit Sparks Financial Concerns

- Pakistan's balance of payments deficit reaches $270 million in May 2024

- Current account deficit decreases to $464 million in FY24

- Efforts to boost exports and control imports show positive impact on economy

Image Credits: pakistantoday

Image Credits: pakistantodayIn May 2024, Pakistan faced a balance of payments deficit of $270 million, signaling a shift in financial dynamics. Efforts to reduce the current account deficit through export growth and import control are underway, with discussions with the IMF for additional support.

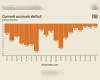

In May 2024, Pakistan faced a balance of payments deficit of $270 million, a significant change from the previous month's surplus of $499 million. This data, sourced from the State Bank of Pakistan (SBP), reveals a notable shift in the country's financial standing. Over the fiscal year FY24, the current account deficit decreased to $464 million, showcasing a marked improvement compared to the $3.76 billion deficit in the same period last year.

The economic growth of Pakistan remained steady, while inflation rates stayed high, contributing to the reduction in the current account deficit. The rise in exports and remittances played a crucial role in this positive development. Additionally, government initiatives, such as maintaining high interest rates and imposing import restrictions, were implemented to help reduce the current account deficit.

During May 2024, Pakistan's exports of goods and services amounted to $3.69 billion, with imports totaling $5.93 billion. Remittances for the same period reached $3.24 billion. For the eleven-month period ending FY24, Pakistan's total exports were $35.81 billion, while imports stood at $57.63 billion, according to SBP data. Worker remittances totaled $27.1 billion, showing an almost 8% increase from the previous year.

The current account balance is crucial for Pakistan, a country heavily reliant on imports to sustain its economy. A widening deficit can impact the exchange rate and deplete foreign exchange reserves. Pakistan is currently in talks with the International Monetary Fund (IMF) for a new extended bailout program to bolster the country's foreign exchange reserves, which currently amount to $9.13 billion.

The recent data on Pakistan's balance of payments highlights the country's efforts to address its financial challenges. With a focus on boosting exports, controlling imports, and seeking external support, Pakistan aims to strengthen its economic position and ensure stability in the global market.