Sunday, December 22, 2024 06:31 PM

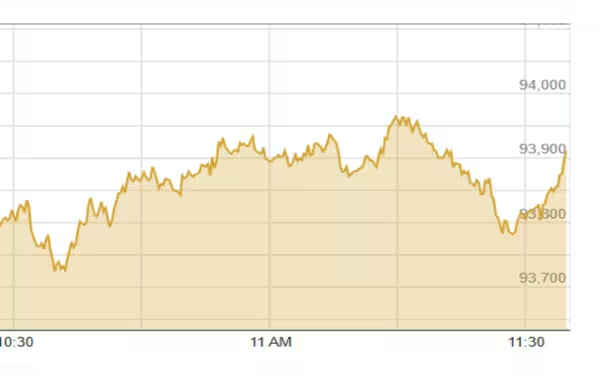

PSX Surges Over 1,200 Points Amid Investor Optimism

- PSX gains over 1,200 points in recent rally.

- Investors await SBP's interest rate decision.

- Positive earnings in energy and technology sectors.

Image Credits: dawn.com

Image Credits: dawn.comThe PSX has surged over 1,200 points, driven by investor optimism and upcoming SBP interest rate decisions.

The Pakistan Stock Exchange (PSX) has been experiencing a remarkable surge in recent days, with investors showing a strong appetite for shares. On Friday, the market witnessed an impressive gain of over 1,200 points, marking a significant milestone in what many are calling an unabated rally. This upward trend reflects the growing confidence among investors, despite the ongoing economic challenges faced by the country.

The driving force behind this bullish sentiment can be attributed to several factors. Firstly, the anticipation surrounding the upcoming meeting of the State Bank of Pakistan (SBP)’s Monetary Policy Committee on December 16 has created a buzz in the market. Investors are keenly awaiting any announcements regarding changes in the key interest rate, which could have a profound impact on the economy and the stock market.

Moreover, the recent positive developments in various sectors, including energy and technology, have further fueled investor enthusiasm. Companies in these sectors have reported better-than-expected earnings, leading to increased buying activity. As a result, many analysts believe that the PSX is on a path to recovery, with potential for sustained growth in the coming months.

However, it is essential to approach this rally with caution. While the current momentum is encouraging, investors should remain vigilant about the underlying economic conditions. Factors such as inflation, currency fluctuations, and global market trends can significantly influence the stock market's performance. Therefore, it is crucial for investors to conduct thorough research and consider diversifying their portfolios to mitigate risks.

The recent climb of over 1,200 points at the PSX is a testament to the resilience of the market and the optimism of investors. As the SBP prepares for its upcoming meeting, all eyes will be on the decisions made regarding interest rates. For now, the bulls are in control, but prudent investment strategies will be key to navigating the ever-changing landscape of the stock market.