Thursday, July 4, 2024 05:36 PM

State Bank of Pakistan Faces Decision on Interest Rates

- Consumer inflation at 11.8% vs. policy rate at 22%

- Experts anticipate interest rate reduction

- Potential economic growth with lower interest rates

Image Credits: dawn.com

Image Credits: dawn.comThe State Bank of Pakistan is considering a rate cut to address high inflation and stimulate economic growth. Experts anticipate a reduction in interest rates, but the extent of the cut remains uncertain.

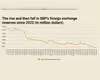

The State Bank of Pakistan is currently facing a challenging decision regarding its policy rates in light of the significant gap between the consumer inflation rate and the current policy rate. With consumer inflation at 11.8% and the policy rate at 22%, experts are closely monitoring the situation.

A recent survey conducted by Topline Securities has shown that 90% of participants are expecting a reduction in interest rates. However, there is a divergence of opinions on the extent of the rate cut, with projections ranging from 100 to 300 basis points.

If the State Bank decides to lower interest rates, it could potentially stimulate economic growth by making borrowing cheaper for businesses and consumers. This move may also help in addressing the challenges posed by high inflation rates.

While the anticipation of a rate cut is high, the State Bank of Pakistan is likely to proceed cautiously to ensure a balanced approach that considers both inflationary pressures and the need to support economic growth. Investors and the general public will be closely watching for any developments in this regard.