Monday, December 30, 2024 05:09 PM

Ethereum Surpasses Bitcoin Amid Regulatory Optimism

- Ethereum shows impressive performance compared to Bitcoin.

- Investors optimistic about new SEC Chair's crypto stance.

- ETH options lead in trading volumes and open interests.

Image Credits: prnewswire_apac

Image Credits: prnewswire_apacEthereum outperforms Bitcoin as investors anticipate a more favorable SEC Chair, boosting ETH trading volumes and open interest.

The cryptocurrency market has been buzzing with activity lately, particularly with Ethereum (ETH) showing impressive performance compared to Bitcoin (BTC). This shift in dynamics can be largely attributed to the recent announcement regarding U.S. SEC Chair Gary Gensler's impending departure at the end of the Biden administration's term. Investors are reacting positively, and the market is witnessing a notable increase in open interest for ETH perpetual contracts.

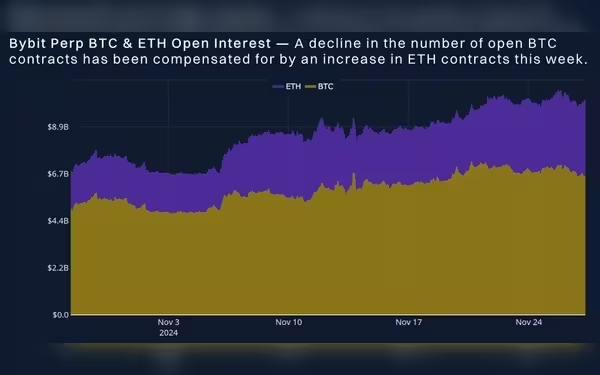

As the news of Gensler's exit spreads, many investors are feeling optimistic about the future of cryptocurrency regulation. The anticipation of a more crypto-friendly SEC Chair after Gensler's last day on January 20, 2025, has led to a surge in interest for ETH. In fact, while BTC has seen a gradual decline in open interest, ETH contracts have been on the rise. This trend indicates that more traders are willing to invest in ETH, which is also capturing a larger share of daily trading volumes over the past six months, despite the overall market being slower this week.

On the other hand, Bitcoin's price has been retreating from the $100,000 mark, which has affected its volatility. The ATM (at-the-money) volatility term structure has flattened, with short-tenor options dipping below 60%. This decline in volatility is a pattern that has been observed since the U.S. election, and it suggests that while BTC remains a popular choice, the demand for short-term options has stagnated.

When we look at ETH options, there is a slightly more bullish sentiment compared to BTC options. Although the markets have recalibrated following the post-election high, call options for ETH are still leading in both trading volumes and open interests. This indicates that traders are more confident in ETH's potential for growth in the near future.

Bybit, the world's second-largest cryptocurrency exchange by trading volume, has been at the forefront of this trading activity. Established in 2018, Bybit offers a professional platform for crypto investors and traders, featuring an ultra-fast matching engine and 24/7 customer service. The exchange has gained a significant user base, serving over 50 million users globally.

The current landscape of cryptocurrency trading is shifting, with Ethereum taking the lead over Bitcoin in several key metrics. As investors await a new SEC Chair who may adopt a more favorable stance towards cryptocurrencies, the market is poised for potential growth. This could be an exciting time for both seasoned investors and newcomers alike, as the dynamics of the crypto market continue to evolve.