Thursday, July 4, 2024 05:51 PM

Australian shares surge on mining and energy sector gains

- S&P/ASX 200 index rises by 0.6% on positive market sentiment

- Key sectors like mining, energy, healthcare, and utilities drive market growth

- Reserve Bank of Australia's upcoming monetary policy decision eagerly awaited by investors

Image Credits: brecorder

Image Credits: brecorderAustralian shares surged on Tuesday, driven by gains in the mining and energy sectors. Investors eagerly await the Reserve Bank of Australia's monetary policy decision for insights into potential interest rate adjustments.

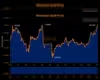

Australian shares experienced a positive trend on Tuesday, primarily influenced by the mining and energy sectors, buoyed by stronger commodity prices. The S&P/ASX 200 index saw a 0.6% increase, reaching 7,724.600 by 0040 GMT. Investors are eagerly anticipating the upcoming monetary policy decision by the Reserve Bank of Australia, which is expected to provide insights into potential interest rate adjustments. Market analysts predict that the central bank will likely maintain its cash rate, with projections indicating a single rate cut for the year.

Key players in the mining industry, such as BHP Group, saw a 1.1% increase, supported by the uptick in iron ore prices. The financials sub-index remained stable ahead of the RBA announcement, with two of the 'Big Four' banks witnessing gains while National Australia Bank and ANZ Group faced declines. Energy stocks also saw a 0.6% rise as global oil prices stabilized, with companies like Woodside Energy and Santos posting gains.

The healthcare sector surged by 0.7%, driven by CSL, while the utilities sector experienced a notable 2.2% increase, attributed to AGL Energy raising its annual earnings outlook by 6.8%. Information technology firms and real estate stocks also saw positive movements, rising by 1.1% and 1.2%, respectively.

Meanwhile, New Zealand's S&P/NZX 50 index remained steady at 11,840.7900, with the country's monetary policy decision scheduled for later this month. In its recent meeting, the Reserve Bank of New Zealand opted to maintain its cash rate at 5.5%.

In conclusion, the Australian market showcased resilience and optimism, driven by favorable developments in key sectors. The upcoming decisions by both the Reserve Bank of Australia and the Reserve Bank of New Zealand are poised to provide further clarity on the economic landscape, shaping investor sentiment moving forward.