Tuesday, July 2, 2024 03:11 PM

BOJ hints at potential rate hikes amid rising JGB yields

- BOJ board member suggests rate hikes due to yen depreciation impact on inflation

- Market speculates on policy adjustments and possible rate increase in July

- Investors globally closely monitor JGB market for financial market implications

Image Credits: brecorder

Image Credits: brecorderJapanese government bond yields surge as BOJ hints at potential rate hikes due to yen depreciation impact on inflation. Market speculates on policy adjustments and possible rate increase in July, with global investors closely monitoring JGB market for financial market implications.

Recently, Japanese government bond (JGB) yields have surged to multi-year highs, driven by worries about potential tightening measures by the Bank of Japan (BOJ). A BOJ board member hinted at the possibility of rate hikes if significant yen depreciation starts impacting inflation, leading to speculations in the market.

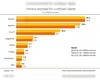

The 10-year JGB yield has climbed to 1.070%, its highest level since December 2011, while the two-year yield reached 0.365%, marking a 15-year peak. Despite suspected interventions by Tokyo in April and May, market watchers are closely following the movements of the yen.

Market sentiment is now leaning towards anticipating policy adjustments by the BOJ, with talks of a potential rate increase in July. Recent signals from the central bank, such as reduced bond purchases, have fueled expectations of a possible tapering of its bond-buying program at the upcoming June meeting.

BOJ board member Seiji Adachi highlighted the likelihood of rate hikes in response to sharp yen depreciation affecting inflation. The uptick in US bond yields has also impacted JGB yields, with the five-year yield hitting its highest level since February 2011 and the 20-year yield reaching a level last seen in July 2011.

Amidst the backdrop of rising yields and evolving central bank policies, investors are keeping a close eye on developments in the JGB market for potential repercussions on global financial markets.

The surge in JGB yields reflects growing concerns about BOJ's potential tightening measures and their impact on inflation. With market expectations shifting towards policy adjustments and possible rate hikes, the financial landscape is witnessing significant movements. Investors worldwide are closely monitoring the situation for its implications on global markets, highlighting the interconnected nature of the financial world.