Saturday, November 16, 2024 05:53 PM

Equities Decline Following Early Termination of IPP Contracts

- Stock market ends six-session winning streak.

- Profit-taking driven by IPP contract terminations.

- Foreign investors remain net sellers amid uncertainties.

Image Credits: dawn

Image Credits: dawnThe Pakistani stock market declines as profit-taking ensues following the early termination of IPP contracts, ending a six-session winning streak.

KARACHI: The stock market in Pakistan faced a setback on Thursday, ending a six-session winning streak. This decline was primarily driven by profit-taking among investors, particularly after the government announced the early termination of power purchase contracts with certain Independent Power Producers (IPPs). Such decisions can create ripples in the market, as they raise concerns about the stability and future of energy supply in the country.

Ahsan Mehanti from Arif Habib Corporation noted that the market closed under pressure due to worries surrounding the premature termination of contracts with IPPs, which are linked to tariff issues. Additionally, the unresolved $16 billion debt reprofiling with China added to the uncertainty. The instability of the Pakistani rupee and the looming challenges posed by the International Monetary Fund (IMF) regarding energy subsidies and government spending further fueled selling pressure, resulting in a bearish market close.

Topline Securities Ltd reported that the KSE-100 index witnessed a fierce struggle between buyers (bulls) and sellers (bears), with the latter ultimately prevailing. The announcement from two IPPs, Hub Power and Lal Pir Power Ltd, regarding the early termination of their contracts significantly impacted market sentiment. Furthermore, Hubco revealed that the Government of Pakistan (GoP) and the Central Power Purchasing Agency-Guarantee (CPPAG) had reached an agreement to settle the company’s outstanding receivables up to October 1.

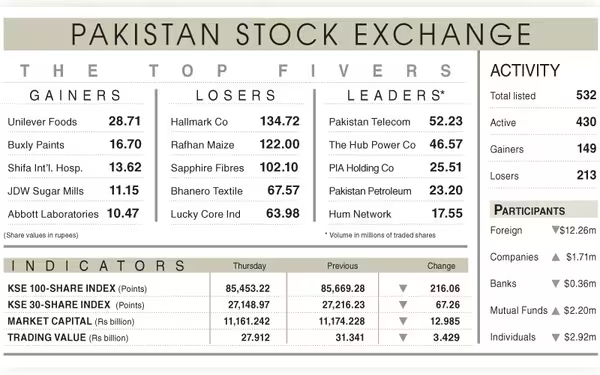

Key players contributing positively to the index included Pakistan Petroleum Ltd, Pakistan State Oil (PSO), National Bank, Pakistan Telecommunication Company (PTC), and The Searle Company, which collectively added 245 points. However, this was offset by losses from Fauji Fertiliser, Engro Fertiliser, Habib Bank, and Lucky Cement, which collectively wiped out 267 points. Consequently, the benchmark index recorded a loss of 216.06 points, or 0.25%, closing at 85,453.22.

The trading volume also saw a decline, dropping by 15.48% to 503.75 million shares, while the traded value fell by 5.17% to Rs31.34 billion compared to the previous day. Notable stocks contributing to the trading volume included Pakistan Telecom with 52.23 million shares, Hub Power Company with 46.57 million shares, and PIA Holding Co with 25.51 million shares.

In terms of price movements, Unilever Foods saw the most significant increase, rising by Rs28.71, followed by Buxly Paints at Rs16.70 and Shifa International Hospital at Rs13.62. Conversely, Hallmark Co experienced the largest drop, losing Rs134.72, followed by Rafhan Maize at Rs122.00 and Sapphire Fibres at Rs102.10.

Foreign investors remained net sellers, offloading shares worth $12.26 million, while mutual funds took the opportunity to buy shares worth $2.20 million. This trend indicates a cautious approach from foreign investors amidst the prevailing uncertainties.

The recent developments in the energy sector and the stock market highlight the interconnectedness of economic policies and market performance. Investors are advised to stay informed and consider the broader implications of government decisions on their investment strategies. As the situation evolves, it will be crucial to monitor how these factors influence market dynamics in the coming days.