Thursday, July 4, 2024 05:40 PM

Federal Reserve Sparks Copper Surge on Inflation Data

- Copper prices surge due to speculation on Federal Reserve's interest rate cut.

- Industrial metals market influenced by unexpected U.S. inflation data.

- Long-term demand outlook crucial amidst short-term market dynamics.

Image Credits: brecorder

Image Credits: brecorderThe surge in copper prices, driven by U.S. inflation data and Fed rate cut speculation, impacts the broader industrial metals market. Understanding short-term dynamics and long-term demand is key for investors.

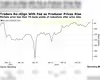

Following the release of lower-than-expected U.S. inflation data, copper prices experienced a notable increase. This surge was triggered by speculation that the Federal Reserve might lower interest rates in September. The unexpected flat headline inflation in the previous month, contrary to the anticipated 0.1% increase, played a significant role in influencing this market shift.

The benchmark copper on the London Metal Exchange surged by 2.3% to $9,981 per ton at 1300 GMT after the announcement of the inflation data. This rise came after copper had hit a seven-week low of $9,680 per ton earlier, representing an 11% decline from its record high in May.

Traders linked the increased buying activity in industrial metals to the expected dovish statement from the Federal Reserve post its policy meeting and the weakened U.S. dollar. The depreciation of the dollar makes dollar-priced metals more affordable for holders of other currencies. Despite the current soft demand for copper, driven partly by factors like artificial intelligence, industry experts believe that long-term demand drivers are yet to materialize. High inventory levels, such as the four-year high of 336,964 tonnes in Shanghai Futures Exchange-monitored warehouses, suggest a subdued buying interest.

In the realm of other metals, tin witnessed a 4% surge to $33,200 after recently hitting a one-month low, marking a 32% increase for the year. Algorithmic traders have been actively engaging in dip-buying activities in markets like nickel, tin, and zinc, utilizing technical signals for their trading decisions. Tin inventory on the Shanghai Futures Exchange has decreased by 9.4% since the beginning of June, currently standing at 16,297 tons.

Aluminium prices rose by 0.7% to $2,552, zinc saw a 3% increase to $2,857.5, lead ticked up by 0.8% to $2,173, and nickel was up by 1.2% at $18,025.

The recent surge in copper prices, driven by the unexpected U.S. inflation data and speculation around a potential Fed rate cut, has had a ripple effect on the broader industrial metals market. While short-term market dynamics are influenced by factors like currency fluctuations and trading algorithms, long-term demand outlook remains a key consideration for industry experts. As investors navigate through these fluctuations, keeping an eye on both macroeconomic indicators and specific market trends will be crucial for informed decision-making.