Thursday, July 4, 2024 05:57 PM

U.S. Treasury Yields Surge on Inflation Data Release

- Benchmark 10-year yield hits 4.5%, highest since November

- Unexpected rise in inflation raises doubts on Fed rate cuts

- Market experts contemplate Fed refraining from rate cuts

Image Credits: Bloomberg.com

Image Credits: Bloomberg.comU.S. Treasury yields surged post inflation data release, raising doubts on Fed rate cuts. Market experts contemplate Fed's stance amidst economic challenges.

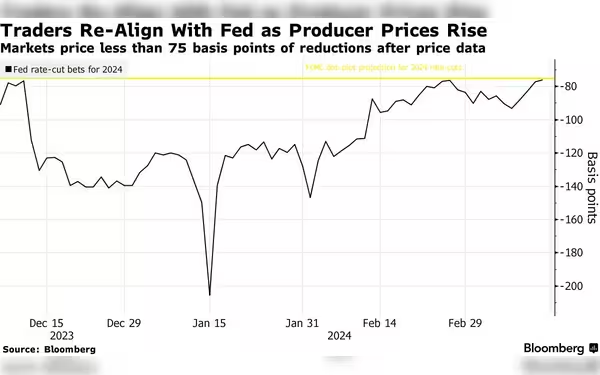

On Wednesday, U.S. Treasury yields experienced a significant spike following the release of inflation data that surpassed expectations. The benchmark 10-year yield surged over 10 basis points to reach 4.5%, marking its highest level since November of the previous year. This surge was triggered by a notable increase in U.S. consumer prices during March, driven by elevated costs of gasoline and shelter. The unexpected rise in inflation has raised doubts about the Federal Reserve's potential decision to cut interest rates in June.

The two-year yields, which are closely tied to monetary policy expectations, also saw a sharp increase of nearly 20 basis points, reaching 4.937%, their highest level since November. Traders in Fed funds futures adjusted their expectations for interest rate cuts in 2024, reducing them to 43 basis points from the previous 67 points prior to the inflation data release.

Market experts are now contemplating the possibility of the Fed refraining from rate cuts in the near term, with discussions emerging about the potential for rate hikes later this year. The latest data from the Labor Department's Bureau of Labor Statistics revealed a 0.4% increase in the consumer price index for March, with a 3.5% rise over the past 12 months, surpassing economists' forecasts.

Despite the challenges posed by higher inflation, some analysts believe that the long-term economic outlook still points towards a cooling economy. The surge in Treasury yields is expected to make buying bonds for anticipated interest rate cuts an attractive option once again, as the Fed aims to transition to a less restrictive and more neutral stance over time.

The upcoming $39 billion auction of 10-year Treasury paper will serve as a crucial test of investor sentiment towards Treasuries in the current economic climate.