Saturday, November 16, 2024 07:40 PM

Global Manufacturing Demand Declines in October: GEP Index Insights

- Significant decline in factory demand across major economies.

- U.S. manufacturers face steep cutbacks in purchasing volumes.

- China shows signs of recovery amid global manufacturing challenges.

Image Credits: prnewswire_apac

Image Credits: prnewswire_apacIn October, global manufacturing demand weakened significantly, impacting major economies, particularly the U.S. and Europe, while Asia shows resilience.

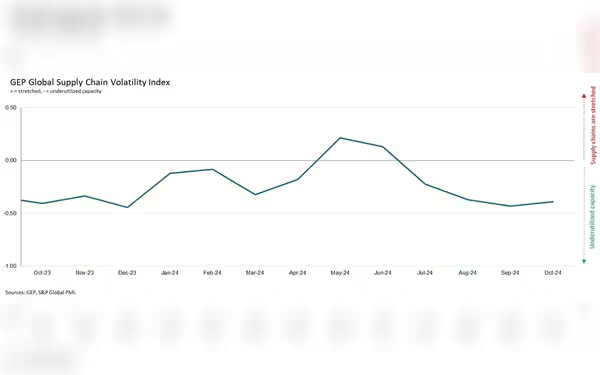

In October, a significant shift was observed in the global manufacturing landscape, as suppliers catering to major economies reported a notable decline in demand. This trend is highlighted by the GEP Global Supply Chain Volatility Index, which indicates that many factories are bracing for lower production levels. The situation is particularly pronounced in North America, where factory activity in the United States has seen a steep decline, leading to the most substantial cutbacks in purchasing volumes in over a year and a half.

As the world's largest economy, the U.S. plays a crucial role in global manufacturing. The recent contraction in factory activity suggests that American manufacturers are preparing for a slowdown, which could have ripple effects across various sectors. Meanwhile, suppliers in Asia also reported some spare capacity, although the situation is not as severe as in Western markets. Notably, India continues to experience strong growth in certain manufacturing industries, which contrasts sharply with the challenges faced by its Western counterparts.

Interestingly, China's factory production showed signs of recovery in October, with procurement activity increasing after three months of decline. However, this positive development is tempered by the fact that manufacturers in Japan and South Korea have reduced their purchasing, signaling potential trouble ahead for these economies.

Europe's manufacturing sector remains under significant pressure, with many vendors operating well below their capacity. This underutilization reflects a persistent lack of demand in key manufacturing hubs across the continent. Germany's automotive sector, in particular, is struggling, which poses a considerable challenge to overall factory output in Europe. Furthermore, October marked the 14th consecutive month of negative indicators for items in short supply, suggesting an oversupply of commodities and intermediate goods compared to current manufacturing needs.

According to Todd Bremer, vice president of GEP, "We're in a buyers' market. October is the fourth straight month that suppliers worldwide reported spare capacity, with notable contractions in factory demand across North America and Europe, underscoring the challenging outlook for Western manufacturers." This statement encapsulates the current state of the market, where manufacturers are facing an uphill battle to maintain production levels amidst declining demand.

As we look ahead, it is essential for manufacturers to adapt to these changing conditions. The contrasting resilience seen in Asian markets, particularly in China and India, may offer valuable lessons for Western manufacturers. Embracing innovation, improving efficiency, and exploring new markets could be key strategies for navigating this challenging landscape. Ultimately, understanding these dynamics will be crucial for businesses aiming to thrive in an increasingly competitive global economy.