Thursday, July 4, 2024 06:04 PM

Global Petrol Demand Growth Slowing by 2024

- Electric vehicle adoption impacting petrol demand growth

- China and US leading the shift towards electric vehicles

- Refining margins under pressure due to changing market dynamics

Image Credits: brecorder

Image Credits: brecorderThe global petrol market is experiencing a slowdown in demand growth by 2024, driven by electric vehicle adoption, changing consumption patterns, and market dynamics. Refining margins are under pressure as regions like China and the US lead the shift towards electric vehicles, while challenges persist in the US and Europe due to stagnant demand and rising competition.

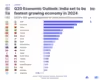

Global petrol demand growth is expected to slow down significantly by 2024, with analysts predicting a halving of growth due to various factors impacting major markets such as China, the United States, and Europe. The shift towards electric vehicles in China and the US, along with a return to normal consumption patterns post-COVID-19, are key drivers behind this trend.

Wood Mackenzie forecasts a modest rise in demand of 340,000 barrels per day this year, reaching 26.5 million barrels per day, a stark decline from the 700,000 barrels per day growth seen in 2023. China, nearing peak transport fuel demand, and the US, surpassing it, are witnessing a slowdown in petrol consumption growth due to higher electric vehicle adoption rates.

Rystad Energy estimates global gasoline demand to reach around 26 million barrels per day by 2024, up by 300,000 barrels per day from the previous year. China, a significant player in the gasoline market, is expected to lead in electric vehicle sales, influencing global trends.

While regions like India and Indonesia are experiencing a surge in gasoline demand driven by robust car sales and economic growth, the US and Europe are facing challenges. US gasoline consumption is stabilizing, while Europe is seeing stagnant demand amidst rising competition from new refineries.

Refining margins are under pressure in key markets like the US and Europe, with expectations of flat demand and increased competition. Margins have fluctuated due to various factors such as refinery outages, freight costs, and geopolitical events impacting energy infrastructure.

In conclusion, the global petrol market is undergoing a significant transformation, with electric vehicle adoption, changing consumption patterns, and market dynamics reshaping the industry landscape. As demand shifts and competition intensifies, refining margins and market players will need to adapt to these evolving trends to stay competitive in the future.