Thursday, July 4, 2024 05:41 PM

Government Budget Proposals Under Scrutiny for Unequal Tax Burden

- Salaried class burdened with additional taxes, while privileged sectors enjoy exemptions

- Government fails to address spending habits, focuses on increasing salaries for employees

- Lack of accountability in budget planning process leads to disillusionment among citizens

Image Credits: Center on Budget and Policy Priorities

Image Credits: Center on Budget and Policy PrioritiesGovernment budget proposals face criticism for unequal tax distribution, lack of accountability, and failure to prioritize economic recovery and sustainability.

Government budget proposals play a crucial role in shaping the economic landscape of a country. In recent times, the budget plans put forth by various officials have come under scrutiny for their impact on different segments of society. One common trend observed is the tendency to burden already heavily taxed groups while exempting certain privileged sectors.

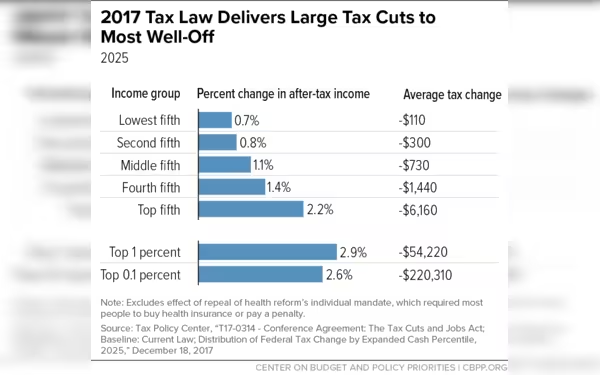

Despite promises to broaden the tax base, the salaried class continues to bear the brunt of additional direct and indirect taxes. Meanwhile, agriculturalists and retailers enjoy exemptions, leading to an uneven distribution of the tax burden. The government's failure to address its own spending habits exacerbates the situation, with a focus on increasing salaries for government employees rather than implementing necessary austerity measures.

To truly demonstrate a commitment to economic recovery, the government should have targeted untaxed sectors and made tough decisions regarding its own expenses. However, a lack of accountability is evident as no significant actions have been taken in this direction. Simple measures such as restricting the purchase of official vehicles and promoting cost-effective travel for government trips could have signaled a responsible approach to fiscal management.

The disproportionate burden of additional taxes on the general public, coupled with the reluctance of politicians to make personal economic sacrifices, highlights a concerning lack of accountability in the budget planning process. This trend not only impacts taxpayers but also contributes to a growing sense of disillusionment among the younger generation. Moving forward, it is essential for policymakers to prioritize transparency, fairness, and long-term economic sustainability in budget decisions to ensure a more equitable and prosperous future for all citizens.