Thursday, July 4, 2024 05:42 PM

IMF Warns of Oil Price Surge Impact

- IMF expresses concerns over oil price spike's impact on global economy

- US shows strong economic performance, Europe faces subdued growth outlook

- Tight monetary policies in Europe affecting consumption and investment

Image Credits: Mint

Image Credits: MintThe IMF warns of the potential impact of the recent surge in oil prices on the global economy. While the US economy shows strength, Europe faces challenges with subdued growth and tight monetary policies.

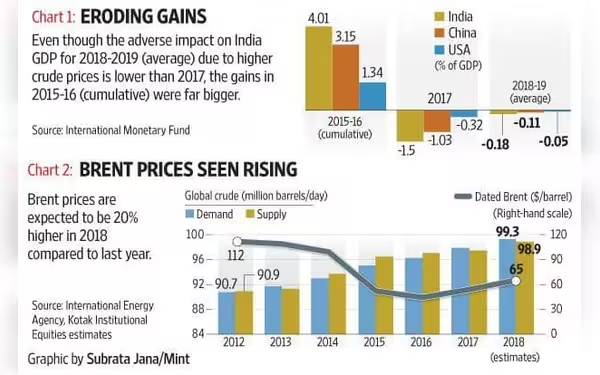

The recent surge in oil prices, driven by escalating tensions in the Middle East, poses a threat to the optimistic outlook for the world economy, according to the International Monetary Fund (IMF). The IMF's chief economist, Pierre-Olivier Gourinchas, expressed concerns about the potential impact of the oil price spike on global economic growth.

Gourinchas highlighted the IMF's projection of a resilient global economy for 2024, with expected growth of 3.2 percent this year and next. However, he cautioned that disruptions in oil, energy, or commodity prices could derail this positive trajectory. The current inflation rate is forecasted to ease from its post-pandemic peak, but any sustained increase in oil prices could hinder this progress.

While the United States has shown strong economic performance, with robust productivity growth and increased labor supply due to immigration, Europe faces a more subdued growth outlook. The euro area is expected to see modest growth of 0.8 percent this year, rising slightly to 1.5 percent in 2025.

Gourinchas noted that tight monetary policies in Europe, coupled with reduced consumer and business confidence, are impacting consumption and investment. The European Central Bank's plan for an interest rate cut in June aligns with the IMF's view of the region's economic challenges.

In conclusion, the global economy is at a crossroads, balancing resilience in the US with uncertainties in Europe. The evolving situation in the Middle East and its effects on oil prices will be critical factors shaping the economic landscape in the coming months.