Thursday, July 4, 2024 06:20 PM

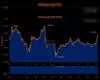

Gold Prices Surge, Impacting Global Consumer Markets

- Gold prices surge, leading to decline in physical purchases in major markets

- India and China offer discounts post festival to boost gold sales

- Global gold trading activities affected by fluctuating prices and demand shifts

Image Credits: brecorder

Image Credits: brecorderGold prices surged globally, impacting consumer markets in India and China. Discounts offered post festivals to boost sales, while trading activities in Singapore, Hong Kong, and Japan were influenced by fluctuating prices and demand shifts.

Gold prices surged this week, causing a ripple effect in major consumer markets worldwide. The increase in prices led to a decline in physical gold purchases, particularly in countries like India and China. Following a significant gold-buying festival in India, dealers in both China and India responded by offering lower premiums and discounts to entice buyers.

In India, where domestic gold prices nearly hit a record high, demand softened post the Akshaya Tritiya festival. Dealers in India began offering discounts on gold prices compared to the previous week, resulting in a decrease in retail demand. The slowdown in gold purchases can also be attributed to fewer weddings taking place, traditionally a key driver of gold sales in the country.

April saw India's gold imports more than double compared to March, reaching a substantial $3.11 billion. Meanwhile, in China, premiums over benchmark spot prices slightly decreased to a range of $16-$30 per ounce. Despite prevailing economic challenges, gold imports are anticipated to remain subdued in the upcoming months due to limited import quotas and other factors that could prevent a significant rise in the Shanghai gold premium.

High gold prices also had an impact on trading activities in other markets. In Singapore, bullion was sold at par to $2.50 premiums, while in Hong Kong, prices ranged from $0.50 to $2.50 premiums. Japan witnessed gold being sold at a premium of $0.25-$1, wider than the previous week. Traders noted a decrease in demand primarily due to a weaker yen and increased profit-taking compared to the previous period.

The fluctuation in gold prices has had far-reaching effects on global markets, influencing consumer behavior and trade dynamics. As countries like India and China adjust their strategies to accommodate changing demand patterns, the future of gold imports and retail sales remains uncertain. Investors and consumers alike are closely monitoring these developments to make informed decisions in the ever-evolving gold market.