Saturday, December 21, 2024 04:36 PM

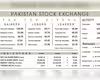

KSE-100 Index Soars Amid Economic Optimism

- KSE-100 reflects top 100 companies' performance.

- Low interest rates boost stock market investments.

- Investors remain cautious amid economic uncertainties.

Image Credits: dawn.com

Image Credits: dawn.comThe KSE-100 index has surged, driven by low interest rates and investor optimism, reflecting a positive shift in Pakistan's economic landscape.

The Karachi Stock Exchange (KSE-100) has witnessed a remarkable surge in recent times, capturing the attention of investors and analysts alike. This index, which reflects the performance of the top 100 companies listed on the exchange, has become a focal point for those looking to capitalize on the shifting economic landscape in Pakistan. As interest rates have been reduced, a significant amount of capital that was previously seeking higher yields has started to flow towards equities, leading to improved returns for investors.

The relationship between liquidity and equity prices is crucial to understanding this phenomenon. When interest rates are low, borrowing becomes cheaper, and investors are more inclined to invest in stocks rather than keeping their money in low-yielding savings accounts or bonds. This influx of capital into the stock market has resulted in a notable run-up in equity prices, which is primarily driven by the availability of liquidity. In essence, the dynamics of interest rates and broader macroeconomic factors play a pivotal role in shaping the performance of the KSE-100.

Moreover, the current economic climate in Pakistan has created a favorable environment for stock market growth. With various sectors showing resilience and potential for expansion, investors are increasingly optimistic about the future. The KSE-100 serves as a barometer for the overall health of the economy, and its rise reflects a growing confidence among market participants.

However, it is essential for investors to remain cautious. While the upward trend in the KSE-100 is encouraging, it is vital to consider the underlying economic conditions that could impact this growth. Factors such as inflation, political stability, and global economic trends can all influence market performance. Therefore, a well-informed approach to investing is crucial.

The rise of the KSE-100 is a testament to the changing dynamics of the Pakistani economy. As interest rates remain low and liquidity increases, the stock market is likely to continue attracting investment. For those looking to navigate this landscape, understanding the interplay between interest rates and equity prices will be key. As always, informed decision-making and a keen eye on market trends will serve investors well in this evolving environment.