Sunday, December 22, 2024 03:14 AM

KSE-100 Index Soars Amid Economic Recovery

- KSE-100 index delivers 60% return in 2024.

- IMF bailout boosts investor confidence significantly.

- Experts predict index may reach 135,000 by 2025.

Image Credits: brecorder

Image Credits: brecorderThe KSE-100 index has surged 60% in 2024, driven by economic recovery and investor confidence following an IMF bailout.

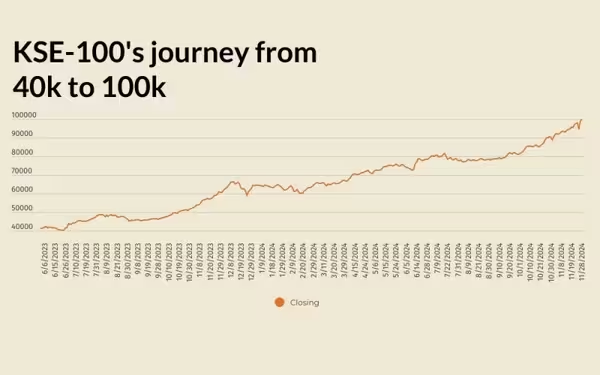

The KSE-100 index, a key indicator of the Pakistan Stock Exchange (PSX), has been making headlines for its remarkable performance in 2024. Starting the year at an impressive 62,451 points, the index has delivered a phenomenal 60% return to investors so far. This surge can be attributed to several factors, including a rebound in Pakistan's economy and a smoother transition between International Monetary Fund (IMF) bailouts, which has significantly boosted investor confidence.

In June 2023, Pakistan finalized a $3-billion Stand-By Arrangement with the IMF, which provided a much-needed economic roadmap. While IMF programs are often viewed with skepticism, they do instill a sense of stability among investors. The KSE-100 has not looked back since the announcement of this bailout, reflecting a growing optimism in the market.

Corporate earnings, particularly in the banking sector, have also played a crucial role in driving stock prices higher. As banks report increased profits, it creates a ripple effect, encouraging more investment in the stock market. Additionally, the stability of the exchange rate and a more controlled pace of inflation have further supported the KSE-100's upward trajectory.

Looking ahead, experts predict that the KSE-100 may continue to rise as liquidity shifts from fixed-income asset classes to the stock market. With falling interest rates making bonds and other fixed-income investments less attractive, many investors are likely to turn their attention to equities. Some brokerage houses even forecast that the index could reach levels between 125,000 and 135,000 by 2025.

The central bank is set to hold its next monetary policy committee meeting on December 16, where the current key policy rate stands at 15%. Analysts are anticipating a potential cut of around 200 basis points in this upcoming meeting, which could further enhance the appeal of the stock market.

The KSE-100's impressive performance this year is a testament to the resilience of Pakistan's economy and the confidence of its investors. As the market continues to evolve, it is essential for investors to stay informed and consider the broader economic indicators that could impact their investment decisions. The future looks promising, but as always, caution and due diligence remain key in navigating the ever-changing landscape of the stock market.