Thursday, July 4, 2024 06:01 PM

Oil prices surge on supply shortfall anticipation

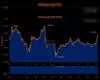

- Brent crude futures hit $85.55 per barrel

- Analysts foresee supply deficits due to heightened summer demand

- Geopolitical tensions and weather conditions impact oil price movements

Image Credits: arabnewspk

Image Credits: arabnewspkOil prices surge due to summer demand and supply concerns, influenced by geopolitical tensions and weather events.

Oil prices surged on Monday as market participants anticipate a supply shortfall in the third quarter. This increase is primarily driven by heightened summer fuel consumption and ongoing production cuts by OPEC+ countries. Brent crude futures soared to $85.55 per barrel, while US West Texas Intermediate crude futures reached $82.03. The momentum from June, where both contracts experienced a 6% uptick, has carried over into July. Brent has maintained levels above $85 for the past two weeks following the extension of oil output cuts by OPEC+. Analysts foresee supply deficits looming in the near future as the demand for transportation and air-conditioning peaks during the summer months, leading to a depletion of fuel inventories.

Factors Influencing Oil Prices

The Energy Information Administration's report for April revealed an uptick in oil production and demand for key petroleum products, bolstering prices. Despite these positive indicators, concerns persist regarding US gasoline demand and apparent demand from China. Notably, China's role as a major consumer and importer of crude oil significantly impacts the global market dynamics. Additionally, hopes of a potential interest rate cut by the US Federal Reserve and geopolitical tensions in Europe and the Middle East have provided some support to oil prices. Analysts are eyeing the possibility of WTI prices hitting $85 per barrel if they can sustain levels above the 200-day moving average of $79.52.

Monitoring Weather Conditions and Geopolitical Events

Traders are closely monitoring the potential impact of hurricanes on oil and gas production in the Americas as the Atlantic hurricane season commences. The looming threat of Hurricane Beryl approaching the Caribbean with severe weather conditions underscores the need for vigilance in the energy markets. Geopolitical tensions in key regions also add an element of uncertainty to oil price movements, emphasizing the interconnected nature of global events on commodity prices.

Conclusion

As oil prices continue to climb on the back of supply concerns and market dynamics, it is essential for stakeholders to remain attuned to the evolving landscape. The intricate interplay between demand, production, geopolitical factors, and weather events underscores the volatility inherent in the energy markets. Navigating these complexities requires a nuanced understanding of the various drivers shaping oil price movements, ensuring informed decision-making in an ever-changing environment.