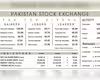

Saturday, November 16, 2024 07:41 PM

Pakistan Fails to Meet IMF Tax Collection Target

- Pakistan collected only Rs1,000 of Rs10 billion target.

- Tajir Dost scheme aims to enhance tax compliance.

- Failure jeopardizes relationship with the IMF.

Image Credits: tribune.com.pk

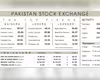

Image Credits: tribune.com.pkPakistan's tax collection under the IMF's Tajir Dost scheme falls drastically short, raising concerns over economic management and compliance.

In a significant setback for Pakistan's economic management, the country has failed to meet a crucial target set by the International Monetary Fund (IMF). The IMF had stipulated that Pakistan must collect Rs10 billion from traders under a new tax scheme known as the Tajir Dost scheme during the first quarter of the fiscal year. However, the Federal Board of Revenue (FBR) managed to collect a mere 0.001% of this target, amounting to only Rs1,000. This alarming shortfall raises serious questions about the effectiveness of the government's tax collection strategies and its ability to comply with international financial obligations.

The Tajir Dost scheme was introduced as part of Pakistan's broader efforts to enhance tax compliance among retailers and boost revenue generation. The IMF's conditions are often seen as stringent, but they are designed to ensure that countries like Pakistan can stabilize their economies and manage their debts effectively. The failure to meet the Rs10 billion target not only jeopardizes Pakistan's relationship with the IMF but also casts a shadow over the government's fiscal policies.

Experts suggest that the lack of awareness among traders about the new tax scheme, coupled with the challenges of implementing such policies in a country with a large informal economy, has contributed to this dismal performance. Many small traders may not fully understand the implications of the scheme or may be resistant to change, fearing that increased taxation could hurt their already fragile businesses.

Moreover, the collection of taxes is vital for any government, as it funds essential services such as education, healthcare, and infrastructure development. When tax targets are missed, it can lead to budget deficits, which in turn can result in cuts to public services and increased borrowing. This cycle can create a challenging environment for economic growth and stability.

As Pakistan navigates these turbulent economic waters, it is crucial for the government to engage with traders and provide them with the necessary support and information to comply with tax regulations. Building trust and understanding between the government and the business community will be essential in achieving future tax targets and ensuring the country's economic health.

The failure to meet the IMF's tax collection target is a wake-up call for Pakistan. It highlights the need for more effective communication and education regarding tax policies, as well as the importance of fostering a cooperative relationship between the government and traders. Only through collective effort can Pakistan hope to improve its tax collection and meet its financial obligations, paving the way for a more stable and prosperous future.