Saturday, November 16, 2024 07:55 PM

PSX Gains on Banking and Automotive Sector Resilience

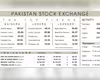

- PSX gains 30 points amid banking and auto sector growth.

- Major declines in key stocks offset market gains.

- Investors urged to remain cautious amid market volatility.

Image Credits: tribune.com.pk

Image Credits: tribune.com.pkThe PSX sees a slight gain driven by banking and automotive sectors, despite declines in key stocks, highlighting market volatility.

The Pakistan Stock Exchange (PSX) has been a focal point for investors and analysts alike, reflecting the economic pulse of the nation. On Friday, the PSX experienced a slight uptick, gaining 30 points in late trading. This modest recovery can be attributed to positive earnings forecasts from the banking and automotive sectors, which have shown resilience and potential for growth.

Despite this upward movement, the overall performance of the index was hampered by significant declines in several key stocks. Notably, companies such as Hub Power, Lucky Cement, Habib Bank, TRG Pakistan, and Service Industries collectively dragged the index down by 327 points. This mixed performance highlights the volatility that often characterizes the stock market, where gains in one sector can be offset by losses in another.

The banking sector, in particular, has been buoyed by expectations of strong earnings, which have instilled confidence among investors. Similarly, the automotive industry is witnessing a resurgence, driven by increased demand and favorable market conditions. These sectors are crucial for the overall health of the PSX, as they contribute significantly to the market's performance.

However, the decline in major stocks serves as a reminder of the inherent risks involved in stock trading. Investors must remain vigilant and informed, as market dynamics can shift rapidly. The performance of the PSX is not just a reflection of individual companies but also of broader economic trends and investor sentiment.

While the PSX's slight recovery is a positive sign, it is essential for investors to approach the market with caution. Understanding the factors that influence stock performance, such as sectoral earnings and market trends, can help investors make informed decisions. As the market continues to evolve, staying updated and adaptable will be key to navigating the complexities of the stock exchange.