Thursday, November 21, 2024 06:29 AM

PSX Profit-Taking Follows Record Bull Run Amid Political Uncertainty

- KSE-100 index peaked at 96,703.83 points.

- Profit-taking led to a decline of 310.21 points.

- Retail stocks, especially KEL, drove initial market surge.

Image Credits: dawn

Image Credits: dawnThe PSX experienced profit-taking after a record bull run, with the KSE-100 index declining amid political noise and retail stock interest.

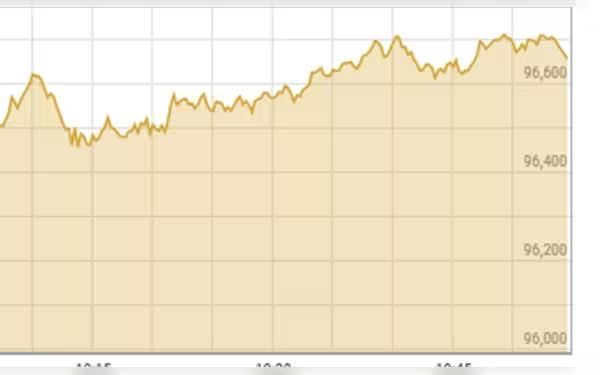

The Pakistan Stock Exchange (PSX) has recently experienced a remarkable surge, reaching record highs during intraday trading. This impressive bull run saw the benchmark KSE-100 index climb by over 800 points in the early hours of Wednesday, reflecting a strong interest from investors. However, as the day progressed, profit-taking emerged amidst political noise, leading to a decline in the index by the end of the trading session.

At its peak, the KSE-100 index rose by 847.17 points, or 0.88 percent, reaching a high of 96,703.83 points. This was a significant increase from the previous close of 95,856.66 points. Unfortunately, the index could not maintain this momentum and closed at 95,546.45 points, down by 310.21 points from the last close.

Market analysts have pointed out that the initial surge was driven by substantial interest in retail-driven stocks, particularly K-Electric Limited (KEL) and Kohinoor Spinning Mills (KOSM). Yousuf M. Farooq, a director of research at Chase Securities, noted that KEL was buoyed by rumors of an upcoming multi-year tariff approval, which could enhance investor confidence and potentially lead to significant transactions.

Farooq also highlighted that while stocks are no longer as cheap as they were last year, they remain reasonably priced due to stabilizing macroeconomic conditions. He believes that this has been a crucial factor in the ongoing rally, which is expected to continue, albeit with periodic corrections. However, he cautioned that political instability, macroeconomic shocks, excessive government spending, and a deteriorating current account position pose significant risks to this momentum.

In addition to the excitement surrounding KEL, flat steel stocks gained attention following a statement from Aisha Steel Mills’ management, which projected an increase in sales to 210,000 tons in the fiscal year 2025, up from 167,000 tons in fiscal year 2024. This positive outlook has contributed to the overall market sentiment.

Interestingly, October marked a milestone for the local market, with 10,001 new stock market accounts opened in Pakistan. While this is a positive development, it still pales in comparison to the 3.5 million accounts opened in India, indicating the latter's more mature market dynamics.

On a brighter note, Farooq pointed out that macroeconomic fundamentals have improved over the past year, a trend that is reflected in the current rally. He also mentioned that funds are shifting from fixed income to equities, a trend that could gain momentum if interest rates decline in December, potentially fueling further growth in the market.

Meanwhile, Mohammed Sohail, the chief executive of Topline Securities, attributed the early morning bull run to "non-stop buying by local mutual funds." He noted that a statement from The Resource Group (TRG) Pakistan Limited regarding its portfolio company, IBEX Limited, also played a role in boosting market volumes and sentiments. TRG Pakistan Limited announced that it had entered into an agreement with IBEX Limited, resulting in the repurchase of approximately 3.56 million IBEX shares from TRG International.

While the PSX has shown remarkable resilience and growth, investors must remain vigilant. The interplay of political factors and macroeconomic conditions will continue to shape the market's trajectory. As the landscape evolves, staying informed and adaptable will be key for investors looking to navigate the complexities of the stock market in Pakistan.