Thursday, November 7, 2024 12:57 PM

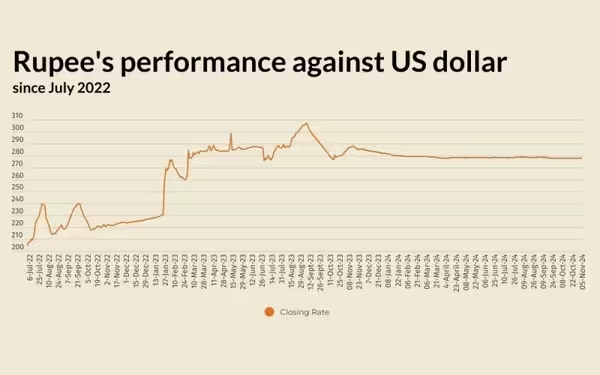

Rupee Declines Marginally Against US Dollar Amid Election Uncertainty

- Pakistani rupee falls 0.02% against US dollar.

- US dollar weakens ahead of presidential election.

- Rupee gains against euro while losing to dollar.

Image Credits: brecorder

Image Credits: brecorderThe Pakistani rupee sees a slight decline against the US dollar as traders react to upcoming presidential elections.

The Pakistani rupee has experienced a slight dip against the US dollar, marking a depreciation of 0.02% in the inter-bank market on Tuesday. This decline means that the rupee closed at 277.84, which is a loss of Re0.05 compared to the previous day when it settled at 277.79, as reported by the State Bank of Pakistan (SBP).

On the international front, the US dollar began the day on a weaker note. Traders were adjusting their positions ahead of the US presidential election, which has been a focal point for many in the financial markets. Recent polls have raised concerns about the chances of Republican candidate Donald Trump, while Democrat Kamala Harris has seen her odds improve, even leading in some betting platforms. This shift in sentiment has caused fluctuations in the dollar's value.

In the past few weeks, many financial analysts had predicted a Trump victory, primarily due to his policies on tariffs and immigration, which are seen as inflationary. These expectations had previously led to a rise in US Treasury yields and a stronger dollar. However, the situation changed overnight when the dollar fell by as much as 0.76% against the euro, reaching a three-week low. This decline was influenced by a weekend opinion poll that unexpectedly showed Harris leading in Iowa, a state traditionally favored by Republicans.

The dollar index, which tracks the performance of the dollar against six major currencies, remained stable at 103.91 as of 0349 GMT, after dipping to 103.67 on Monday, the lowest level since October 21. Just last week, the index had surged to its highest point since July, reaching 104.63.

Oil prices, which are crucial indicators of currency strength, remained steady on Tuesday as the market braces for a closely contested US presidential election. Oil prices had risen over 2% in the previous session after OPEC+ decided to postpone plans to increase production in December. As of 0841 GMT, Brent crude futures were up by 16 cents, or 0.2%, trading at $75.24 a barrel, while US West Texas Intermediate crude was at $71.65 a barrel, up 18 cents, or 0.3%.

In the open market, the Pakistani rupee lost 3 paise for both buying and selling against the US dollar, closing at 276.85 for buying and 278.74 for selling. Conversely, against the euro, the rupee gained 87 paise for buying and 64 paise for selling, closing at 299.58 and 302.58, respectively. The rupee remained stable against the UAE Dirham for buying but gained 1 paisa for selling, closing at 75.26 and 75.96, respectively. Against the Saudi Riyal, the rupee held steady for buying but lost 2 paise for selling, closing at 73.52 and 74.16, respectively.

The fluctuations in the value of the Pakistani rupee against the US dollar and other currencies reflect the ongoing uncertainties in both local and international markets. As the US presidential election approaches, traders and investors are closely monitoring developments, which could lead to further volatility in currency values. Understanding these dynamics is crucial for anyone looking to navigate the complexities of the financial landscape.