Thursday, July 4, 2024 06:18 PM

Tax Authorities Strive to Boost Revenue Generation Amid Budget Challenges

- Eliminating exemptions and focusing on real estate transactions

- Implementing stricter regulations for non-compliant taxpayers

- Aiming for a 1% primary surplus and 12.9 trillion tax revenues

Image Credits: tribune.com.pk

Image Credits: tribune.com.pkThe current budget presents challenges for tax authorities aiming to boost revenue generation through strategies like eliminating exemptions, focusing on real estate transactions, and enforcing compliance. The objectives include achieving a 1% primary surplus, reducing the fiscal deficit, and enhancing tax collection efficiency.

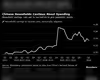

The current budget is posing a significant challenge for tax authorities as they strive to boost revenue generation. The key strategies include eliminating exemptions, focusing on real estate transactions, and implementing stricter regulations for non-compliant taxpayers. The ultimate goal is to achieve a 1% primary surplus, reduce the fiscal deficit to 6.9%, curb inflation to 12%, and collect 12.9 trillion in tax revenues through the Federal Board of Revenue (FBR).

The budget aims to strengthen the country's financial position by increasing revenue streams and ensuring compliance with tax laws. By removing exemptions and targeting real estate transactions, the government hopes to enhance tax collection efficiency. The focus on enforcing regulations for non-filers is crucial for closing loopholes and improving overall tax compliance.

The current budget's objectives are ambitious but necessary for the country's economic stability. By addressing revenue challenges through strategic measures, the government aims to create a more sustainable financial framework. Understanding these goals and the efforts to achieve them is essential for citizens to grasp the importance of fiscal responsibility and tax compliance.