Tuesday, July 2, 2024 04:28 PM

Wall Street reacts to geopolitical tensions and corporate earnings

- Dow Jones closes down 1.2% due to Middle East tensions

- Oil and gold prices surge amid geopolitical uncertainty

- Major banks report strong earnings despite market turmoil

Image Credits: The Karostartup

Image Credits: The KarostartupWall Street faces downturn due to Middle East tensions, while major banks report strong earnings amidst global market volatility.

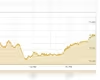

Wall Street experienced a significant downturn on Friday, with the Dow Jones Industrial Average closing down 1.2 percent at 37,983.24 points. The decline was attributed to concerns over escalating tensions in the Middle East, particularly fears of a potential conflict involving Iran and Israel.

The market reacted negatively to reports of a possible Iranian attack on Israel in retaliation for a strike in Damascus. President Joe Biden's warning to Iran further fueled apprehensions among investors, leading to a sell-off throughout the trading session.

Oil and gold prices surged in response to the geopolitical uncertainty, with oil prices rising over two percent before stabilizing. Gold, considered a safe-haven asset, surpassed $2,400 per ounce as investors sought refuge from market volatility.

Corporate Earnings Season and Economic Data

Despite the market turmoil, major banks such as JPMorgan Chase, Wells Fargo, and Citigroup reported strong earnings for the first quarter. While their performance exceeded expectations, stock prices of these banks fluctuated, with JPMorgan Chase witnessing a notable 6.5 percent decline.

The positive earnings results come amidst a backdrop of robust economic data, which has dispelled earlier speculations of imminent interest rate cuts by the US Federal Reserve. The US economy's resilience has raised hopes for sustained corporate profitability, easing concerns over potential Fed interventions.

Global Market Reactions

While European markets displayed mixed trends, London stocks surged following reports of consecutive growth in the UK economy. The UK's economic recovery trajectory has bolstered investor confidence, signaling a potential rebound from the recessionary pressures of the previous year.

The strengthening US dollar, driven by diminishing expectations of rate cuts, reached a 34-year high against the yen. This development prompted Japanese officials to consider market interventions to support their currency amidst the prevailing currency dynamics.

Conclusion

The market volatility witnessed on Friday underscores the impact of geopolitical uncertainties on global financial markets. As investors navigate through evolving geopolitical risks and economic indicators, the resilience of major economies and corporate sectors will continue to shape market sentiments in the coming weeks.