Thursday, July 4, 2024 05:36 PM

Xiao-I Corporation Enters Securities Purchase Agreement with Institutional Investor

- Xiao-I Corporation issues senior convertible notes to institutional investor

- Convertible notes valued at $3,260,870 with 8% Original Issue Discount

- Proceeds from offering to be used for working capital and general corporate purposes

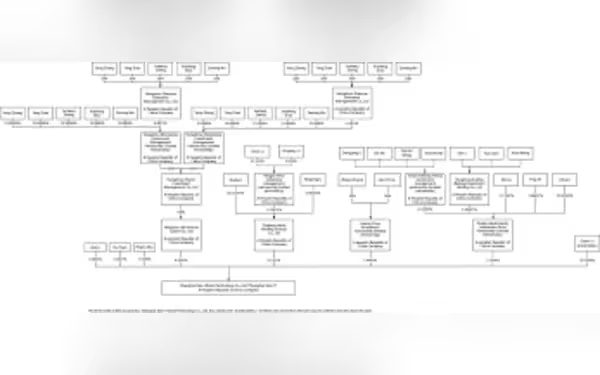

Image Credits: SEC.gov

Image Credits: SEC.govXiao-I Corporation, a leading cognitive intelligence company in China, announces a securities purchase agreement involving senior convertible notes and ADSs. The company aims to utilize the proceeds for working capital and furthering its AI technologies for industrial digitization.

Xiao-I Corporation, a leading cognitive intelligence company based in China, has revealed a recent securities purchase agreement with an institutional investor. The agreement involves the issuance and sale of senior convertible notes valued at $3,260,870. These notes, which come with an 8% Original Issue Discount, can be converted into the company's ordinary shares represented by American Depositary Shares (ADSs). Additionally, the company is offering 1,000,002 ADSs at par to the investor, with restrictions on their transfer until the notes are converted.

The Notes are set to mature 360 days after the Issuance Date and can be converted into the company's ADSs at a price of $1.00 per ADS. They will accrue interest at a rate of 6.0% per annum, which increases to 15% in case of default. Payments under the Notes will take priority over subordinated debts of the company and its subsidiaries.

Holders of the Notes have the option to convert the principal amount, along with accrued interest, into Conversion Shares represented by Conversion ADSs at the Conversion Price of $1.00 per ADS, subject to adjustments for certain transactions, or at the Alternative Conversion Price as defined in the agreement.

The issuance of the Notes, Conversion ADSs, and Pre-Delivery ADSs is being carried out through a prospectus supplement under the company's effective shelf registration statement on Form F-3. The proceeds from this offering will be used for working capital and general corporate purposes.

Xiao-I Corporation specializes in cognitive intelligence technologies like natural language processing, voice and image recognition, machine learning, and affective computing. The company's goal is to promote industrial digitization and intelligent transformation through its advanced AI technologies.

Investors are advised to be cautious about forward-looking statements in this announcement, as they highlight potential risks and uncertainties that could affect the company's future performance. These statements are based on the company's current plans, objectives, and strategies, taking into account factors such as business development, competition, regulatory changes, economic conditions, and other risks disclosed in the company's filings with the SEC.

Xiao-I Corporation's recent securities purchase agreement marks a significant step in its financial strategy, aiming to strengthen its position in the cognitive intelligence sector. With a focus on cutting-edge AI technologies and a commitment to driving industrial digitization, the company continues to pave the way for innovation and growth in the field of cognitive intelligence.