Thursday, July 4, 2024 05:48 PM

Shehbaz Sharif announces minimal tax rate for 2024-25 budget

- Government's commitment to supporting average and less affluent sectors

- Introduction of minimal tax rate to create a more equitable tax system

- Focus on tax reforms and digitalization to boost revenue generation

Image Credits: radio.gov.pk

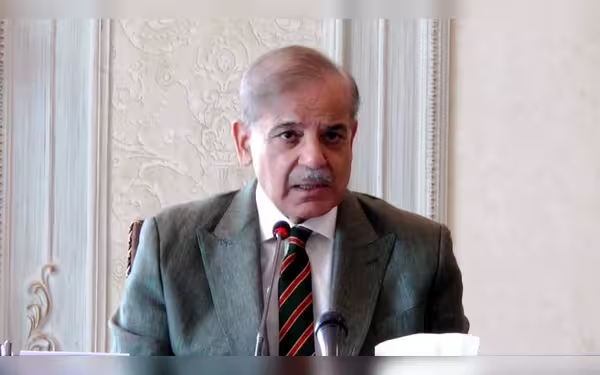

Image Credits: radio.gov.pkPrime Minister Shehbaz Sharif emphasizes government's support for average and less affluent sectors through a minimal tax rate in the 2024-25 budget, aiming to create a fair and prosperous economic environment.

Prime Minister Shehbaz Sharif, during a recent high-level review meeting in Islamabad, highlighted the government's commitment to supporting the average and less affluent sectors of society through the implementation of a minimal tax rate in the fiscal budget for 2024-25. The meeting, which was attended by key officials, focused on crucial topics such as tax reforms, digitalization of the economy, and strategies aimed at boosting revenue generation.

The decision to introduce a minimal tax rate underscores the government's efforts to create a more equitable tax system that eases the financial burden on individuals and businesses with limited resources. By ensuring that the tax burden is distributed fairly across different income groups, the government aims to promote economic inclusivity and support the growth of small-scale enterprises.

Over the years, Pakistan has been striving to enhance its tax system to make it more efficient and transparent. Tax reforms play a crucial role in ensuring that the government can collect revenue effectively to fund public services and infrastructure development. By digitalizing the economy, authorities can streamline tax collection processes, reduce tax evasion, and improve overall compliance.

The government's decision to implement a minimal tax rate for the average and less affluent sectors reflects a step towards creating a more inclusive and supportive economic environment. Through ongoing tax reforms and digitalization efforts, Pakistan aims to strengthen its revenue generation mechanisms and foster sustainable economic growth. By prioritizing the needs of vulnerable segments of society, the government demonstrates its commitment to building a fair and prosperous future for all citizens.