Thursday, November 7, 2024 01:35 AM

ASEAN FinTech Funding Surges Over Tenfold, Powered by GenAI and Quantum Computing

- ASEAN FinTech funding increased more than tenfold since 2015.

- Singapore and Thailand lead in attracting FinTech investments.

- GenAI and quantum computing are revolutionizing the FinTech landscape.

Image Credits: prnewswire_apac

Image Credits: prnewswire_apacASEAN's FinTech funding has surged over tenfold since 2015, driven by GenAI and quantum computing, with Singapore and Thailand leading investments.

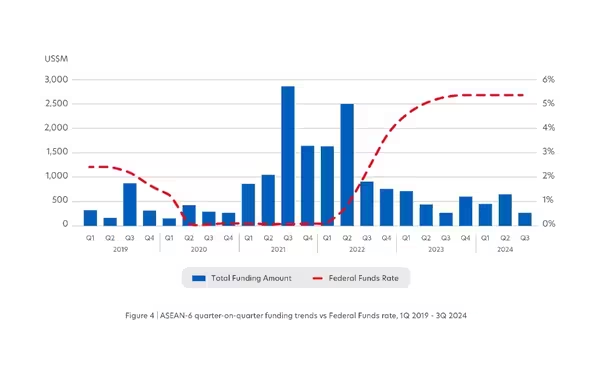

In recent years, the Financial Technology (FinTech) sector in the ASEAN region has witnessed remarkable growth, transforming the way financial services are delivered and accessed. Since 2015, funding for FinTech in ASEAN has skyrocketed, increasing more than tenfold. This surge is not just a local phenomenon; it reflects a broader trend where the global FinTech landscape is also evolving rapidly. The rise of digital payments, alternative lending, and other innovative financial solutions has been at the forefront of this transformation.

As of 2024, Singapore and Thailand have emerged as the leading countries attracting significant investments in FinTech. This year, they have drawn the most funding, showcasing their robust ecosystems that support startups and established companies alike. The latest report, titled "FinTech in ASEAN 2024: A Decade of Innovation," highlights the journey of FinTech in the region over the past ten years. It was jointly launched by UOB, PwC Singapore, and the Singapore FinTech Association, emphasizing the collaborative efforts that have fueled this growth.

One of the key drivers behind this exponential growth is the increasing integration of advanced technologies such as Generative Artificial Intelligence (GenAI) and quantum computing. These technologies are set to revolutionize the FinTech landscape, enabling companies to offer more personalized services, enhance security, and improve operational efficiency. As these innovations become more prevalent, they will likely open new avenues for growth and investment in the sector.

The report not only reflects on the past decade but also looks forward to the future of FinTech in ASEAN. With the ongoing advancements in technology and a supportive regulatory environment, the region is well-positioned to continue its upward trajectory. Investors and entrepreneurs alike are optimistic about the potential for further innovation and growth.

The FinTech sector in ASEAN is on the brink of a new era, driven by technological advancements and a vibrant investment landscape. As we move forward, it is essential for stakeholders to remain agile and responsive to the changing dynamics of the market. The future of FinTech in ASEAN looks bright, and with continued collaboration and innovation, it is poised to redefine the financial services industry in the region.