Sunday, July 7, 2024 11:37 AM

Asian Stock Markets Surge on Political Developments

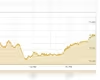

- Stock markets in Asia reach 27-month high driven by softer US economic data

- UK election and French political developments influence market sentiment

- US economic data signals potential weakness in employment figures

Image Credits: brecorder

Image Credits: brecorderAsian stock markets hit a 27-month high due to US economic data, UK election, and French political events. US economic indicators suggest potential employment weakness.

Stock markets in Asia surged to their highest levels in 27 months on Thursday, driven by a combination of factors including softer US economic data and key political developments in the UK and France. The positive momentum in the markets was fueled by the reduced likelihood of a rate cut in the US, leading to increased investor confidence in bonds and commodities while putting pressure on the dollar.

With a holiday in the US resulting in thin trading volumes, investors turned their attention to the UK election where the Labour Party was expected to secure a strong lead over the Conservatives. The anticipation of modest tax and spending plans by the Labour Party aimed at reducing the UK's budget deficit, along with policies that could bring the UK closer to the EU, influenced market sentiment.

In France, polls indicated that the National Rally was unlikely to secure a majority in the upcoming election, as mainstream parties mobilized to prevent a far-right victory. Market indicators such as FTSE futures and sterling showed slight movements in response to these political developments.

Across the Asia-Pacific region, shares outside Japan saw a 0.7% increase, reaching their highest level since April 2022. Japan's Nikkei and Topix also experienced gains, with the Nikkei approaching its peak from March. In the US, futures for the S&P 500 and Nasdaq remained stable after setting new records, despite weaker economic data.

The US ISM measure of services activity dropped to its lowest point since mid-2020, signaling potential weakness in employment figures ahead of the upcoming payrolls report. Analysts observed signs of easing inflation in various surveys, despite some conflicting data. This trend of subdued economic data has led to a decrease in economic surprise indices and growth estimates.

Market expectations for a rate cut in the US have risen, with a higher probability assigned to a cut in September. Yields on 10-year Treasuries declined in response to this sentiment. The weakening dollar has had a positive impact on other currencies, with the euro and Australian dollar strengthening while the yen has depreciated against several currencies.

Commodities experienced mixed movements, with gold prices rising and oil prices showing a slight decrease. The overall market sentiment reflects a shift in expectations regarding interest rates and economic growth in various regions.

The recent surge in Asian stock markets, influenced by economic data and political events, highlights the interconnected nature of global financial markets. Investors are closely monitoring developments in the US, UK, and France, as these factors continue to shape market sentiment and drive fluctuations in various asset classes. As uncertainties persist, staying informed and adapting to changing market conditions remain crucial for investors seeking to navigate the dynamic landscape of international finance.