Thursday, July 4, 2024 06:03 PM

CEO Pay Surges Amid Limited Shareholder Resistance

- CEO compensation rose by 40% between 2017 and 2023

- Only 0.5% of shareholders opposed executive pay packages this year

- Dodd-Frank Act's 'say on pay' provision promotes transparency in executive remuneration

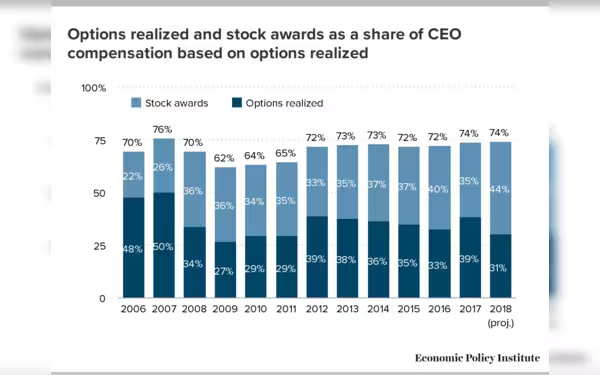

Image Credits: Economic Policy Institute

Image Credits: Economic Policy InstituteThe rise in CEO pay, limited shareholder resistance, and the impact of regulatory mechanisms like the Dodd-Frank Act on executive compensation practices.

Executive salaries at major US corporations have been steadily increasing in recent years, with CEO compensation experiencing a significant rise. Between 2017 and 2023, CEO pay surged by almost 40 percent, reaching an average of $16.3 million per year. This growth rate surpassed the 27 percent increase in average worker salaries over the same period.

Despite the substantial increase in executive pay, shareholders have shown limited resistance. Only 0.5 percent of shareholders voted down executive pay packages at annual meetings this year. While there have been instances of shareholder pushback against excessive CEO compensation in the past, such sentiments seem to have diminished, particularly in the current market environment characterized by soaring stock prices.

The Dodd-Frank Act, a key piece of financial reform legislation, requires companies to seek shareholder approval for executive pay packages every three years through a practice known as 'say on pay.' Although these votes are not binding, rejected pay packages often prompt adjustments by corporate boards. This increased transparency has played a role in curbing some of the more extreme cases of executive compensation practices.

The business landscape is witnessing a shift towards greater accountability and oversight in executive remuneration. The trend of rising CEO compensation underscores the importance of shareholder engagement and regulatory mechanisms like the 'say on pay' provision in promoting transparency and responsible corporate governance.