Thursday, July 4, 2024 05:52 PM

FTSE 100 Surges Amid UK Economic Growth

- FTSE 100 rises by 0.5% led by energy and financial sectors

- UK economy exceeds expectations with 0.7% growth in Q1

- US inflation data anticipation boosts global equities and UK energy stocks

Image Credits: brecorder

Image Credits: brecorderThe FTSE 100 index in the UK shows positive momentum driven by strong economic growth, with a focus on US inflation data and upcoming elections.

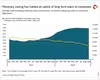

The FTSE 100, Britain's primary stock index, kicked off the day on a positive note as it aimed for its fourth consecutive quarterly gain. This upward trend was fueled by impressive local economic growth figures that surpassed expectations, easing concerns ahead of US inflation data. By 0716 GMT, the FTSE 100 had climbed by 0.5%, with the energy and financial sectors leading the charge. Additionally, the midcap FTSE 250 also saw a modest 0.1% increase.

Official data unveiled that the UK economy expanded by 0.7% in the first quarter of the year, outperforming the projected 0.6% growth. These encouraging numbers come as the nation gears up for parliamentary elections on July 4, with polls hinting at a potential shift in leadership from Conservative Prime Minister Rishi Sunak to Labour Party leader Keir Starmer.

Despite the positive economic indicators, market experts caution that the electorate may not immediately feel the benefits. Nevertheless, there is hope for increased political stability in the UK market post-election.

The eagerly anticipated US personal consumption expenditure (PCE) data is set to be released later today. The possibility of subdued US inflation prompting a Federal Reserve interest rate cut has buoyed global equities. UK energy stocks surged over 1% in anticipation of a Fed rate reduction, driving up oil prices. Financial shares also recorded gains, with banks up by 0.7% and the investment banking sector rising by 0.8%.

On the flip side, JD Sports Fashion shares took a hit, plummeting by 6.1% and landing at the bottom of the FTSE 100. This decline followed a pessimistic revenue forecast for 2025 by US competitor Nike on Thursday.

The FTSE 100's positive trajectory, fueled by robust economic growth and election anticipation, showcases the resilience of the UK market amidst global economic fluctuations. As investors keep a close eye on upcoming data releases and political developments, the outlook remains cautiously optimistic for continued stability and growth in the financial landscape.