Sunday, July 7, 2024 11:17 AM

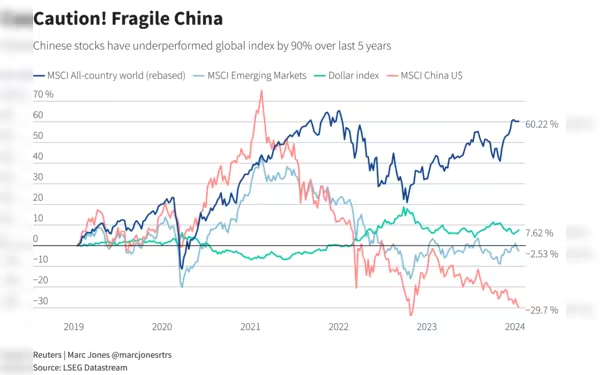

China stocks decline as US rate cut expectations shift

- Traders adjust expectations for US rate cuts due to uncertain inflation trends

- Market sentiment shifts towards a more cautious outlook amid strong dollar

- China's upcoming trade data raises concerns of decline in exports for March

Image Credits: Reuters

Image Credits: ReutersChina stocks and other Asian markets decline as traders adjust US rate cut expectations. Strong dollar and cautious market sentiment amid uncertainties in China's trade performance.

China stocks, along with other Asian markets, experienced a decline on Friday as traders adjusted their expectations for US rate cuts due to uncertain inflation trends. The dollar remained strong, nearing a five-month high, while US Treasury yields also rose following higher-than-expected consumer price data earlier in the week. Despite moderate growth in US producer prices in March, the market sentiment shifted towards a more cautious outlook.

Investors were particularly focused on China's upcoming trade data, with expectations of a decline in exports for March after a strong start to the year. The Shanghai Composite index was down 0.04% at midday, with the CSI300 index also showing a 0.28% decrease. Various sectors, including financials, consumer staples, real estate, and healthcare, experienced losses.

For the week, China's CSI300 was on track for its worst performance since early February, while Hong Kong's Hang Seng managed a slight gain. Chinese H-shares in Hong Kong fell by 1.49%, with the Hang Seng Index down by 1.73%. Notable decliners in the Shanghai index included Innovita Biological Technology, Jiangsu Boqian New Materials Stock, and Dali Pharmaceutical Co Ltd.

Across the region, MSCI's Asia ex-Japan stock index dipped by 0.60%, while Japan's Nikkei index saw a 0.37% increase. The market remains cautious amid uncertainties surrounding US rate cuts and China's trade performance, signaling a challenging period for investors.