Tuesday, July 2, 2024 03:16 PM

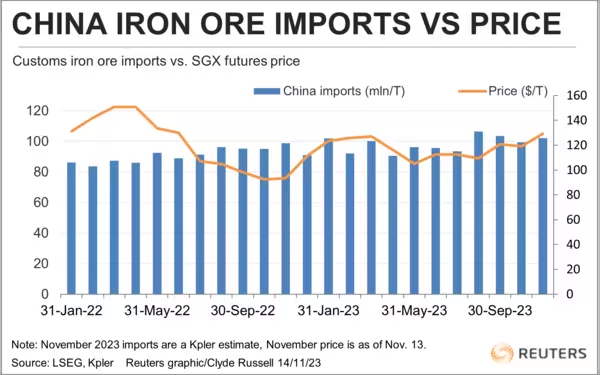

China's Iron Ore Market Faces Uncertainties Amid Economic Factors

- Iron ore futures prices in China decline due to reduced stimulus expectations

- Iron ore inventories at major Chinese ports rise to 145.59 million tons

- Analysts anticipate a decrease in China's crude steel output in 2024

Image Credits: Reuters

Image Credits: ReutersThe iron ore market in China experiences a slight decline influenced by economic factors, government policies, and industry dynamics. Ongoing developments in the broader economy and the steel sector will shape future iron ore prices.

Iron ore futures prices in China experienced a slight decline on Monday due to various factors impacting the market. These include reduced expectations of additional stimulus measures in China, high levels of iron ore stocks at ports, and concerns about potential government intervention following a price surge last week.

The most actively traded September iron ore contract on the Dalian Commodity Exchange closed the morning session 0.52% lower at 862.5 yuan per metric ton, after a significant increase of over 5% the previous week. Similarly, the benchmark May iron ore price on the Singapore Exchange dropped by 0.6% to $115.75 per ton.

Analysts from Everbright Futures noted that iron ore prices are likely to stabilize in the short term as uncertainties persist regarding the potential increase in hot metal output. They attributed last week's price rebound to macroeconomic factors, improved steel margins, and ongoing destocking of steel products.

China's decision to maintain its benchmark lending rates aligns with market expectations, as the country's first-quarter economic data exceeded projections, reducing the immediate need for additional monetary stimulus.

Iron ore inventories at major Chinese ports rose by 0.5% week-on-week to 145.59 million tons as of April 19, according to data from consultancy Mysteel. Additionally, other steelmaking ingredients such as coking coal and coke also experienced declines on the Dalian Commodity Exchange.

Steel benchmarks on the Shanghai Futures Exchange showed mixed results, with rebar, hot-rolled coil, and wire rod prices decreasing, while stainless steel prices saw a slight increase. Analysts at Guotai Junan Securities anticipate a decrease in China's crude steel output and steel consumption in 2024 compared to 2023 levels, influenced by challenges in the property sector.

In conclusion, the iron ore market in China faces a complex landscape influenced by a combination of economic factors, government policies, and industry dynamics. The future trajectory of iron ore prices will likely be shaped by ongoing developments in the broader economy and the steel sector.