Thursday, July 4, 2024 05:34 PM

China Boosts Copper Prices Amid Economic Growth Surge

- Copper prices rise due to increased demand from China

- China's property market reforms stimulate copper market activity

- IMF raises China's economic growth projection to 5%

Image Credits: brecorder

Image Credits: brecorderCopper prices surge as China's demand grows, driven by property market reforms and IMF's economic growth projection increase. Other metals also experience varied movements in the market.

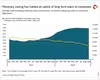

Copper prices experienced a boost on Wednesday, driven by growing expectations of heightened demand from China, the world's largest consumer of the metal. The London Metal Exchange noted a 0.5% uptick in three-month copper prices, reaching $10,556.50 per metric ton. Similarly, the Shanghai Futures Exchange observed a 0.3% increase in the most-traded July copper contract, climbing to 85,020 yuan ($11,729.81) per ton.

China's recent efforts to strengthen its property market have played a significant role in fostering a positive outlook for copper demand. Notably, key Chinese cities like Shanghai have relaxed home buying restrictions by reducing minimum downpayment requirements, thereby stimulating market activity.

The International Monetary Fund (IMF) adjusted its projection for China's economic growth to 5% for the year, citing a robust performance in the first quarter. This revision, up from the previous estimate of 4.6%, signals a more optimistic trajectory for the country's economy.

However, despite these favorable developments, the stability of the US dollar and an uptick in copper inventories have somewhat tempered the price gains. A strong dollar typically results in higher prices for dollar-denominated commodities like copper.

Other metals also witnessed varied movements. LME aluminium rose by 0.4% to $2,740 per ton, nickel increased by 0.2% to $20,500, zinc climbed 0.8% to $3,124, tin edged up by 0.7% to $33,150, and lead declined by 0.3% to $2,337. On the SHFE, aluminium rose by 0.9% to 21,375 yuan per ton, zinc increased by 1.4% to 25,235 yuan, lead advanced by 0.7% to 18,945 yuan, tin was up by 1.2% at 281,470 yuan, while nickel dipped by 0.5% to 154,730 yuan.

The rise in copper prices, fueled by anticipated demand from China and supported by the country's economic growth outlook, reflects a dynamic market influenced by global factors. While challenges such as currency fluctuations and inventory levels pose potential constraints, the overall trend suggests a resilient market responding to both domestic and international dynamics.