Thursday, July 4, 2024 06:15 PM

CliQ Revolutionizes Digital Payments in Jordan

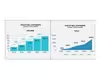

- CliQ facilitates 20.14 million transactions in Q1 2024

- CliQ users reach 1.37 million by April 2024

- Analysts note a shift towards CliQ as preferred payment method

Image Credits: menafn

Image Credits: menafnThe rise of CliQ in Jordan's digital payment landscape is transforming financial inclusion, with 20.14 million transactions in Q1 2024 and a growing user base of 1.37 million by April 2024.

In Jordan, the adoption of digital payment solutions is on the rise, leading to increased financial inclusion in the country. One notable service making waves is CliQ, an instant payment system that has gained significant traction since its launch in 2020.

During the first quarter of 2024, CliQ facilitated an impressive 20.14 million transactions totaling JD3.07 billion. The service's popularity continued to soar in April, with transactions amounting to JD849 million, and in March, reaching JD808 million. By April 2024, the number of CliQ users had grown to 1.37 million, marking a 3.1% increase from the previous year.

CliQ stands out as Jordan's leading Instant Payment System, enabling swift money transfers between bank accounts and mobile wallets across various participating banks. Its seamless integration into mobile banking applications has enhanced accessibility for customers, making transactions more convenient and efficient.

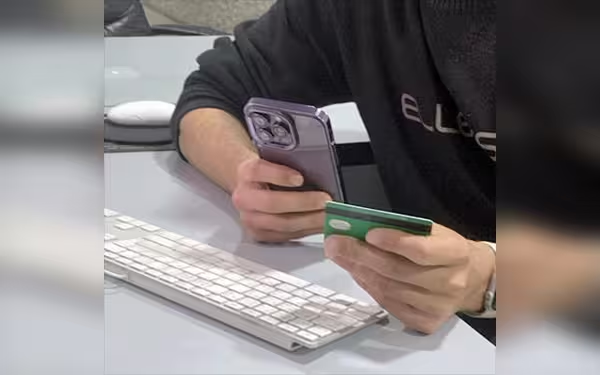

Users like Maria Malak and Ola Mohammad have lauded CliQ for its user-friendly interface and practicality. Maria finds the service simplifies transactions, while Ola appreciates its utility for sending money to her children and making online purchases. The growing preference for CliQ among Jordanians underscores its impact on everyday transactions.

Analysts observe a notable shift towards CliQ as the preferred payment method among the population. With its ease of use and widespread availability, CliQ is reshaping the payment landscape in Jordan, offering a convenient and efficient way for individuals to manage their finances.

The surge in digital payments through services like CliQ reflects a broader trend towards embracing modern financial solutions in Jordan. As more individuals opt for the convenience and efficiency of digital transactions, the country is witnessing a transformation in how payments are made and managed. With its user-friendly features and growing user base, CliQ is playing a pivotal role in driving financial inclusion and shaping the future of payments in Jordan.