Thursday, July 4, 2024 06:06 PM

Dollar Surges Against Yen Amid Inflation Concerns

- Yen weakens as dollar hits highest level since 1990

- US inflation data surpasses expectations, driving market dynamics

- Core CPI rises, leading to dollar strengthening against yen

Image Credits: Yahoo Finance Canada

Image Credits: Yahoo Finance CanadaThe dollar surged against the yen as US inflation data exceeded expectations, impacting forex trading.

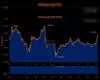

The yen weakened on Wednesday, leading to the dollar reaching its highest level against the Japanese currency since 1990. This movement in the foreign exchange market was driven by concerns over potential intervention by Japanese authorities to support the yen. The latest U.S. inflation data also played a significant role in shaping market dynamics.

In March, the Consumer Price Index (CPI) in the United States rose by 0.4% on a monthly basis, surpassing the 0.3% increase that economists had anticipated. On an annual basis, the CPI increased by 3.5%, slightly higher than the estimated 3.4% growth. When excluding the volatile food and energy components, the core CPI rose by 0.4% month-on-month, exceeding expectations of a 0.3% advance. Annually, the core CPI saw a 3.8% increase, compared to the projected 3.7% rise.

As a result of these developments, the dollar strengthened against the yen, climbing by 0.4% to reach 152.41 yen. This marked the highest level the dollar has reached against the yen since the mid-1990s, reflecting the impact of the inflation data on currency markets.

In conclusion, the interplay between U.S. inflation figures and currency movements, particularly the dollar-yen exchange rate, underscores the intricate relationship between economic indicators and forex trading. Market participants will continue to monitor these factors closely to gauge future trends in the foreign exchange market.