Thursday, July 4, 2024 05:51 PM

Wheat Futures Surge Amid Global Supply Concerns

- Chicago wheat futures rise on dry weather worries in Russia and US

- Corn prices strengthen for significant weekly increase

- Soybean prices stable, set for first weekly rise in over a month

Image Credits: Food Business News

Image Credits: Food Business NewsChicago wheat futures surge due to dry weather in Russia and US, impacting global supply. Corn and soybean prices also see notable gains amidst market activity and revised crop estimates.

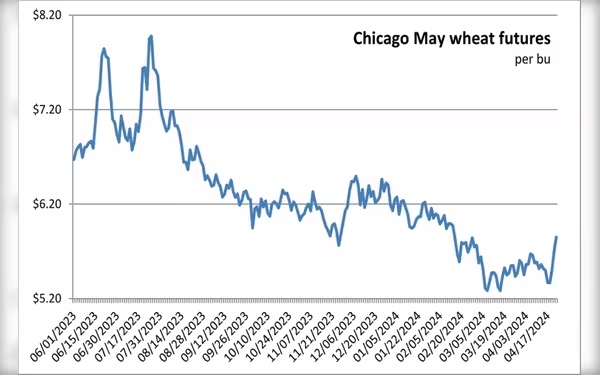

Chicago wheat futures experienced a slight decline on Friday, but are poised to achieve their most significant weekly gain in two years. This surge is attributed to concerns over dry weather conditions in parts of Russia and the United States, which pose a threat to wheat supplies. Corn prices strengthened, heading towards their most substantial weekly increase in 11 months. Meanwhile, soybean prices remained relatively stable, set for their first weekly rise in over a month.

The dryness in southern Russia and eastern Ukraine has raised alarms, with recent rainfall levels falling notably below normal. A report from Rabobank highlighted the potential for significant estimate downgrades if the dry spell persists into May. The wheat contract on the Chicago Board of Trade (CBOT) dipped by 0.2% to $6.19-1/4 a bushel, while corn prices rose by 0.2% to $4.52-3/4 a bushel, and soybeans held steady at $11.79-3/4 a bushel.

Market attention remains focused on the impact of dry weather on wheat production in Russia and the US, prompting investors to address their substantial short positions in wheat. Forecasts indicate limited rainfall relief in southern Russia until early May, although some parts of the US Plains may receive moisture this week. Wheat prices have surged by 9.3% this week, marking the most significant increase since March 2022, while corn and soybeans have also seen notable gains.

The European Commission revised its forecast for the EU's main wheat crop downwards for 2024/25, citing a larger-than-expected decrease in cultivation area. Additionally, dry and hot conditions in northern Argentina may lead to a reduction in the soybean crop estimate for 2023/24. South Africa anticipates an 18.5% decrease in maize harvest for the 2023/2024 season compared to the previous year.

Commodity funds were active in the market, with net buying observed in CBOT wheat, corn, and soyoil futures contracts, while soybean and soymeal futures saw net selling.