Tuesday, July 2, 2024 04:20 PM

Federal Reserve reevaluates rate cuts amid economic strength

- Futures traders reduce rate cut expectations, reflecting confidence in US economy

- Federal Reserve faces challenge of balancing economic growth with inflation concerns

- Treasury yields rise as investors adjust to shifting rate expectations

Image Credits: Reuters

Image Credits: ReutersFutures traders adjust rate cut expectations as Federal Reserve reevaluates amidst economic strength, balancing growth and inflation concerns.

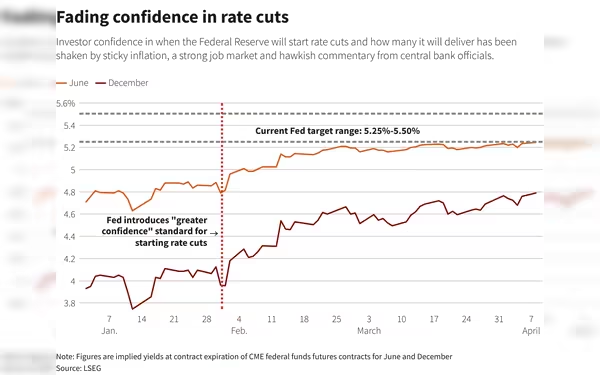

Futures traders have significantly reduced their expectations for interest rate cuts by the Federal Reserve this year, reflecting growing confidence in the strength of the US economy. Data from LSEG and CME Group revealed a notable shift in sentiment, with futures contracts now pricing in around 60 basis points in rate cuts for 2024, down from an initial estimate of 150 basis points.

The likelihood of a 25 basis point cut in June has also decreased to 49%, indicating a more cautious approach by investors. This change in expectations comes as policymakers grapple with the challenge of balancing economic growth with inflation concerns.

The Federal Reserve had previously projected a total of 75 basis points in rate cuts for the year, but recent data showing robust labor market conditions and stronger-than-expected growth have prompted a reevaluation of this forecast. Treasury yields have risen in response to the shifting rate expectations, with the 10-year yield reaching its highest level since November.

In light of the current economic landscape, Fed officials, including Chair Jerome Powell, have emphasized the need for patience in determining the timing and extent of any rate cuts. The upcoming release of the Consumer Price Index for March will be closely monitored for further insights into the inflation outlook and potential policy adjustments.

In conclusion, the evolving expectations around Federal Reserve rate cuts underscore the complex dynamics at play in the US economy. As investors navigate uncertainties surrounding inflation and growth, the central bank faces the delicate task of maintaining stability while supporting continued economic expansion.